by Jim the Realtor | Mar 1, 2024 | 2024, Jim's Take on the Market, Sales and Price Check |

Happy March!

These are updated on the first of the month and are interactive:

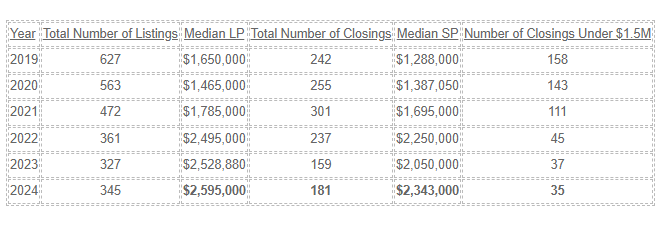

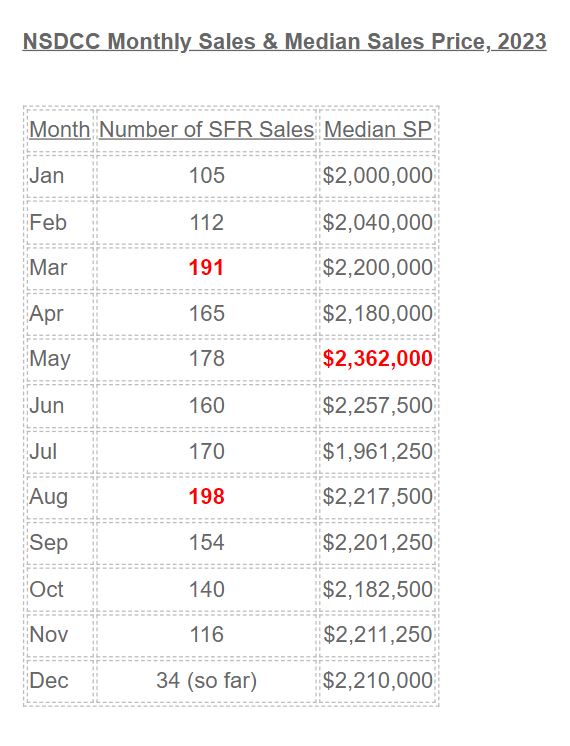

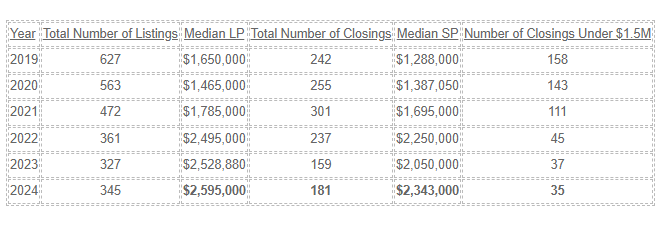

No real concerns there. The low volume causes the bumpy appearance, but for the most part, the pricing is fairly steady. If there were a downward trend for a few months, it would be different.

by Jim the Realtor | Feb 29, 2024 | Jim's Take on the Market |

3 The Point – Coronado, Ca from Spearhead Media on Vimeo.

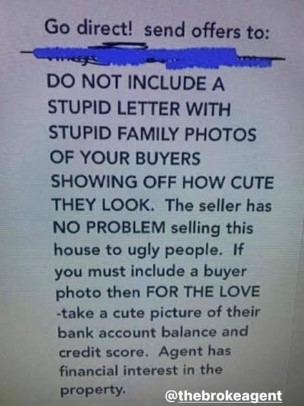

by Jim the Realtor | Feb 20, 2024 | 2024, Jim's Take on the Market, Market Conditions, Spring Kick, Why You Should List With Jim |

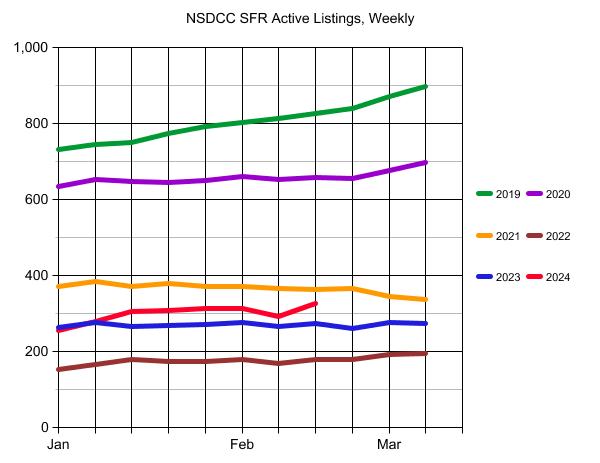

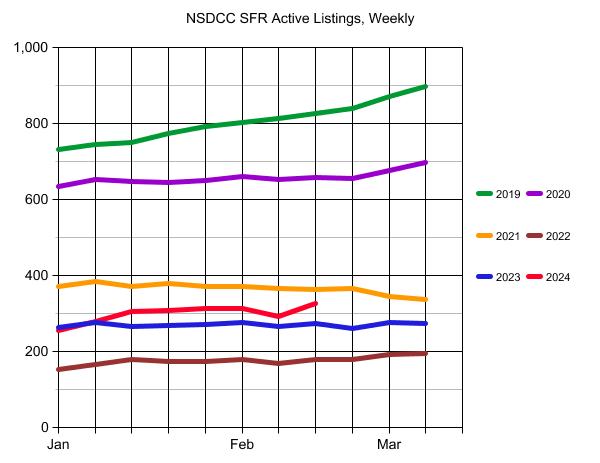

The blip in active listings over the last week isn’t too concerning and could just be from the weather.

The count of active listings is a good indicator of the demand though. During the mega-frenzy conditions from late-2020 through early-2022, you can see that the new listings were being gobbled up as quickly as they came on the market, and there was no build-up of the supply. Last year, the demand was hot enough in the early months that the active-listing counts were fairly flat too.

If this year’s count of active listings surges above 400, it will mean that we are exiting the frenzy days, and the market’s normalization is underway.

It is subject to the overall number of listings, and I’ll reuse yesterday’s chart to show the flow:

NSDCC Listings and Sales, Jan 1 – Feb 15

The total number of listings in 2024 is still in the frenzy range.

It’s the number of active listings that help demonstrate the velocity of the demand. Are they being gobbled up as fast as they hit the market like in recent years, leaving the number of actives fairly steady? Or are the actives starting to pile up, like they used to do? (see the 2019 green line in graph at top)

This is how we will know where the Spring Selling Season is going.

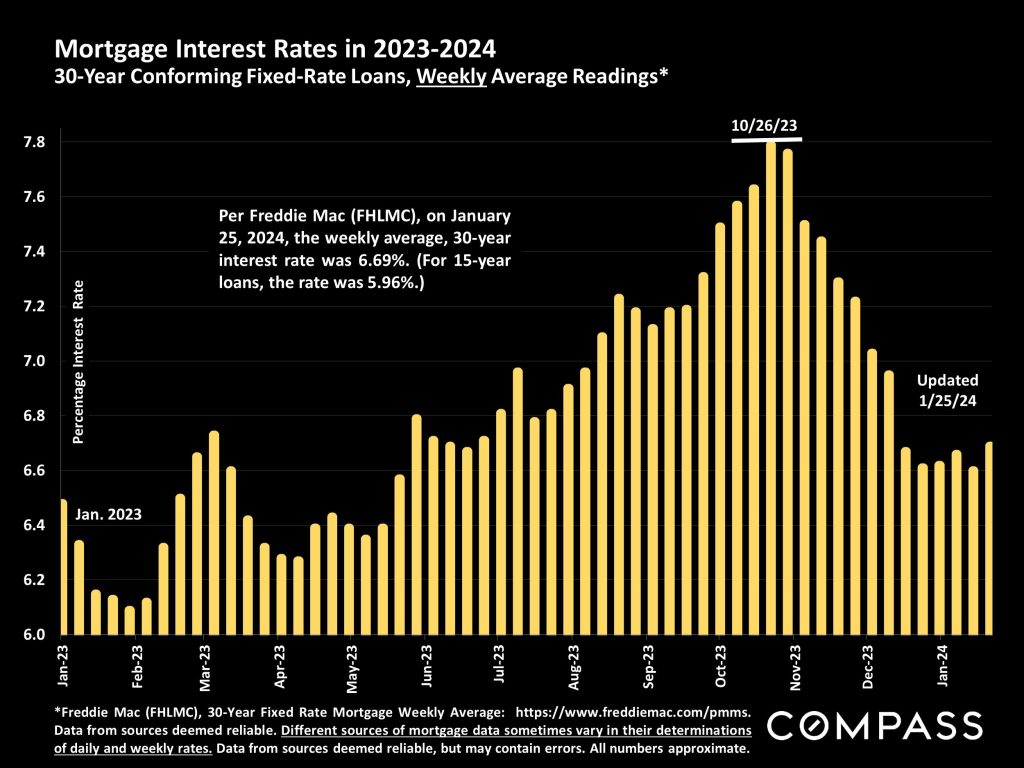

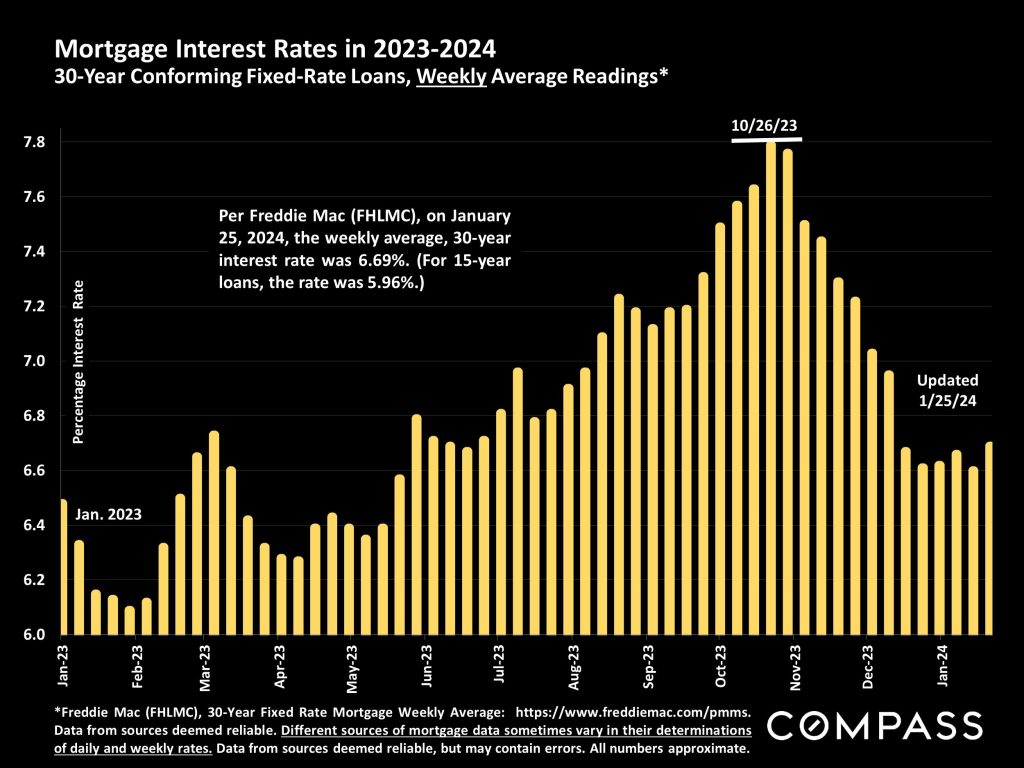

Buyers already have reason to be cautious and wait patiently because Powell opened his big yap and said he was going to lower his rate THREE times in 2024.

If the active listings break out of the frenzy range and start stacking up unsold, it will be irresistible for buyers to wait longer to see if sellers capitulate on price, while hoping rates might come down too.

Want to know where the market is going? Just watch the number/trend of the active listings!

by Jim the Realtor | Jan 31, 2024 | Jim's Take on the Market, Sales and Price Check |

As of February 1st, the January sales count is 103, with the median sales price at $2,275,000, which is a nice pop over the 87 sales from last month. The graph above shows how any momentum was thwarted by rising rates in October, and some relief now is probably contributing to more sales and activity locally (though the mortgage purchase apps were down 11% nationwide today).

By Monday we’ll be able to crown Joe as the winner of the Padres tickets!

Slightly more inventory is the best-case scenario for a healthy selling season. Too many new listings might cause buyers to pause and see where it’s going, but we’re not close to a surge today. A bigger threat would be running out of affluent buyers.

217 – January 2024 Listings (205 in January, 2023)

103 – January Sales so far (median sales price = $2,275,000)

42 – January Sales Under $2,000,000

15 – January Sales Over $4,000,000

$1,100,000 – Lowest-priced sale in January (a detached condo)

$18,500,000 – Highest-priced sale in January (Oceanfront sold off-market)

20 – Median Days on Market

February should be incredible with momentum increasing rapidly. The selling season is here!

Mortgage tip: For those getting a loan under $1,000,000, you can get an FHA rate in the high-5s today!

by Jim the Realtor | Jan 21, 2024 | Jim's Take on the Market |

Thomas Kowal knew living expenses in Los Angeles would be steep. But he was surprised at how steep.

Kowal, 25, had lived on the East Coast for most of his life, but he applied to UCLA for a toxicology PhD program because, he said, he wanted a change of pace and scenery, and he hoped to earn the kind of salary after graduation that would let him afford the California lifestyle.

“When I came here for interviews for a couple days, I really didn’t notice things like gas prices, sales prices that you do notice once you’re on the hook for it,” he said. “Certainly you can see some red flags, and I was prompted to ignore that because I knew living here was my main interest.”

Despite California’s high cost of living, the state has continued to attract more educated and well-paid residents. New census data discount the notion that California’s housing and affordability crisis is pushing away educated residents, resulting in a so-called “brain drain.”

The numbers suggest California’s strong economy in such sectors as technology, medicine and entertainment, as well as its admired higher-education network, continues to draw people.

(more…)

by Jim the Realtor | Jan 19, 2024 | 2024, Contests, Jim's Take on the Market, Padres |

The NSDCC listings inputted between January 1-15 are up 11% YoY:

2023: 100

2024: 111

Take last January’s total of 205 listings + 11% = 228 for the projected winning score, which would blow by everyone. How close the monthly total gets to 228 will tell us if listings are surging or calming as the spring selling season opens. Here are the guesses of the number of January listings – winner gets Padres tickets:

Contest to Guess the Total Number of NSDCC January Listings

142 Anne M

157 Skip

160 doughboy

170 Dale

174 SurfRider

176 LifeIsRadInCbad

180 Kingside

188 Stephanie R.

189 Chris

190 Tom

192 Sara G.

196 Derek

200 Curtis

208 Rob Dawg

210 Bode

213 Shadash

217 Nick

222 Majeed

223 Joe

by Jim the Realtor | Jan 2, 2024 | Inventory, Jim's Take on the Market, North County Coastal |

The NSDCC inventory is starting off the new year with virtually identical numbers as it did in 2023!

The big difference?

Last year everyone thought we had a recession coming, and this year it’s all blue sky ahead.

At the beginning of 2023, the 30-year mortgage rate was 6.48% and all we heard was that existing homeowners would never sell because their existing 3% rate had them ‘locked-in’.

Today’s rate is 6.61% and everyone says that the lower rates will free up inventory this year!

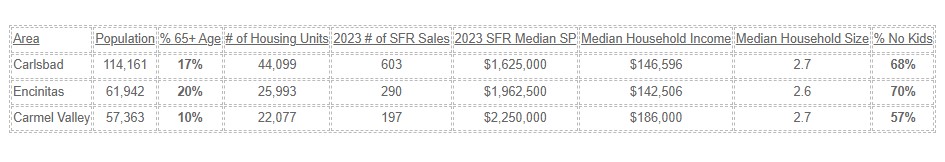

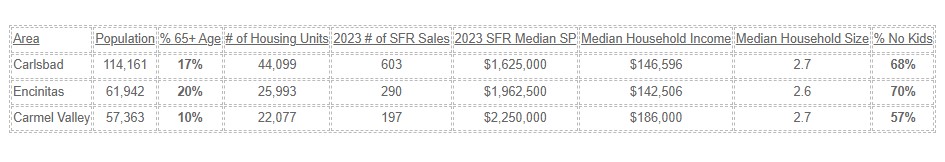

Let’s examine the statistics that will give us a better feel for the future of home sales between La Jolla and Carlsbad. These are the three areas that are full of the homogeneous tract homes that give us a better read on the trends – they had 62% of the NSDCC sales last year:

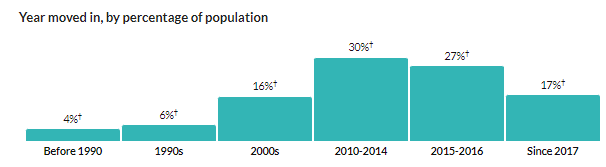

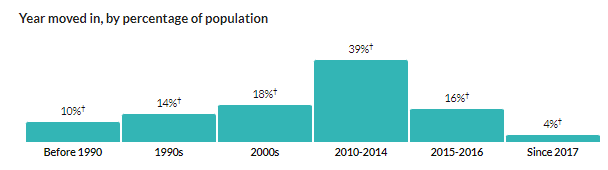

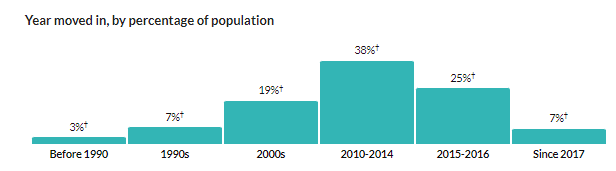

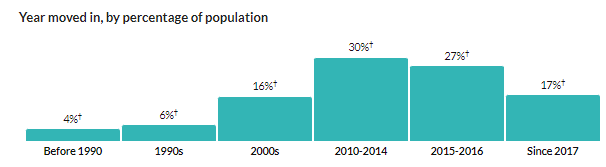

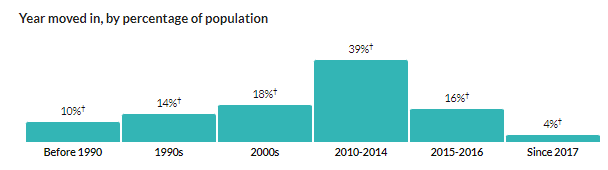

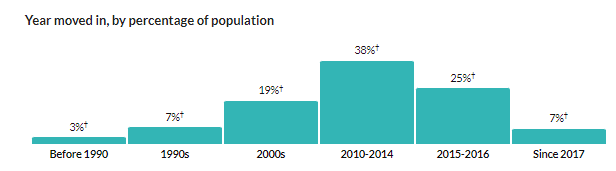

To say that we’re in a mature market controlled by baby boomers is putting it lightly. The ‘locked-in’ effect has been around for a long time for whatever reason – but mostly because we live in paradise:

Carlsbad, CA

Encinitas,CA

Carmel Valley 92130

The vast majority of those who have been in their home since 2016 or longer are ‘locked-in’ because of the price they paid – they aren’t going to pay double or triple what they paid for their current home to just move down the street or around the corner. If they have lived in the same home this long, chances are they will stay to the end – and we’re talking about 80% to 90% of today’s homeowners!

Thankfully, life happens. Death, divorce, and job transfers will keep causing homes to come up for sale.

It will take a 20% YoY surge in NSDCC inventory this year just to match the number of homes for sale in 2022, and I’ll be happy if it is just a 10% increase over last year!

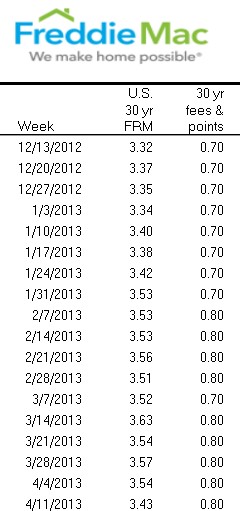

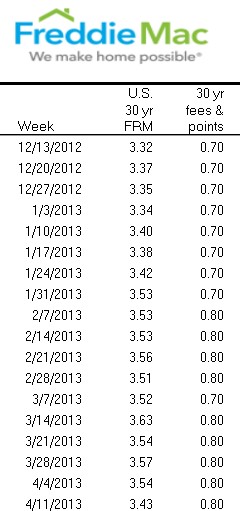

But we have become accustomed to frenzy conditions, and for many it is all they know. The current environment feels somewhat like 2013 again, which was the last time we had a non-covid surge. We were coming off a hot 4Q12, even though rates didn’t change much:

But the market exploded in 2013, just because. I think it’s going to happen again this year, just because.

We’ll find out soon enough – our first listing of the year will hit the market a week from today!

(more…)

by Jim the Realtor | Dec 15, 2023 | 2024, Jim's Take on the Market |

The big difference between last year and now is that the 2023 pricing has been on a slow steady climb, instead of the tumult caused last year by the sudden upward shift in mortgage rates.

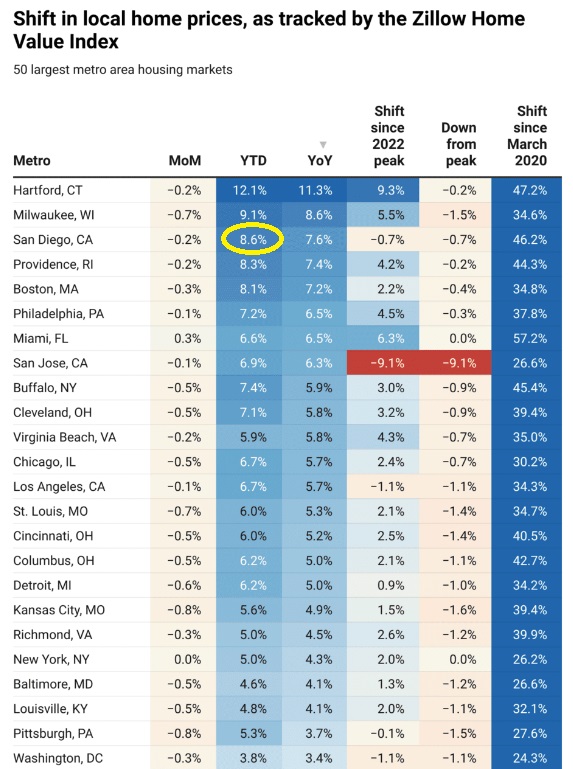

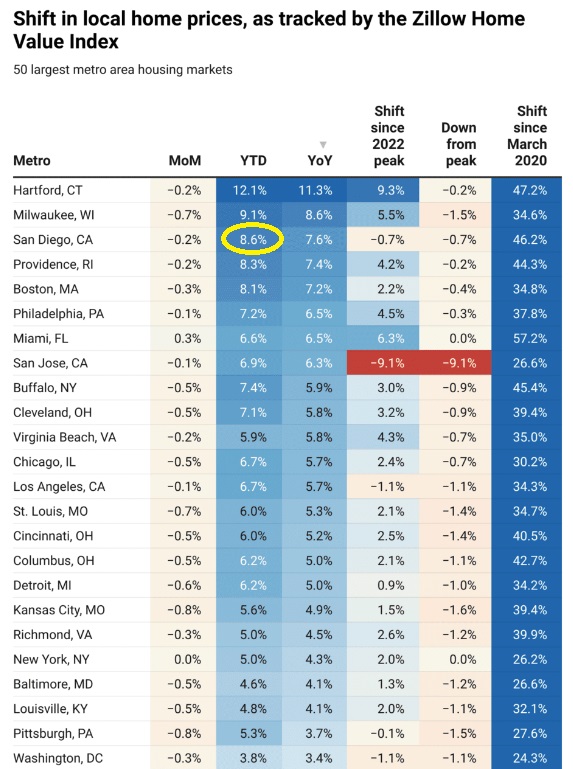

San Diego is leading all the higher-end luxury markets for YTD pricing!

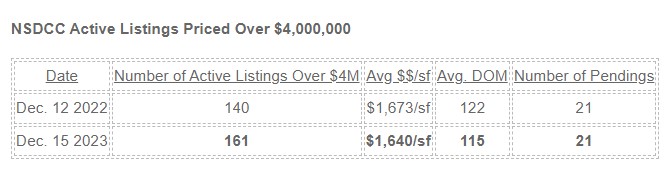

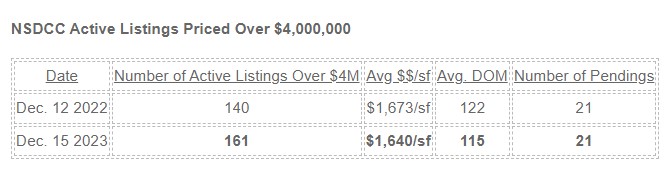

Another comparison where it counts – on the higher-end, where active (unsold) listings are sure to pile up quickly in a soft market. But not yet, and if we’ve made it through this stretch, then the future market with lower rates should survive ok too:

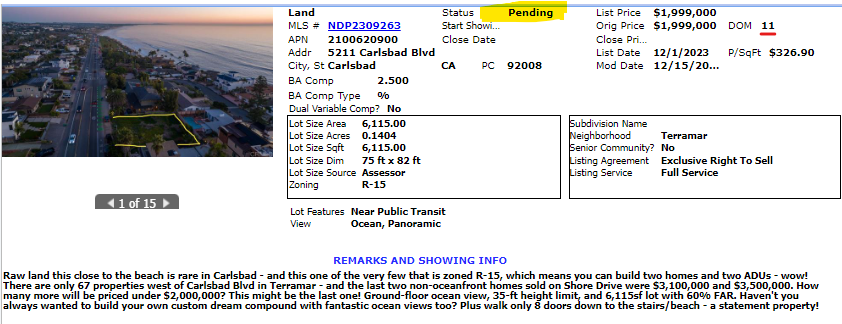

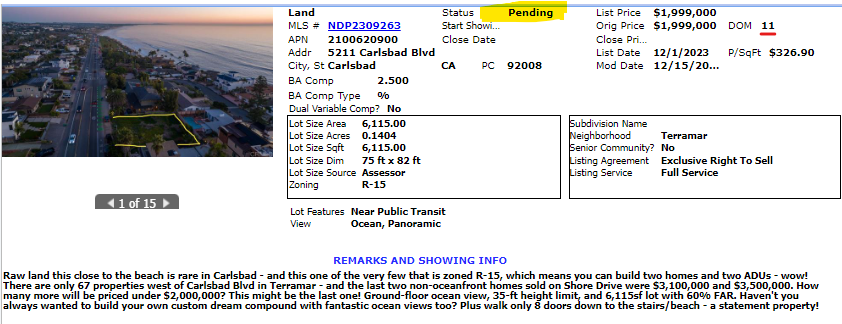

Our vacant-land listing went pending today too!

by Jim the Realtor | Dec 14, 2023 | Forecasts, Interest Rates/Loan Limits, Jim's Take on the Market, Spring Kick |

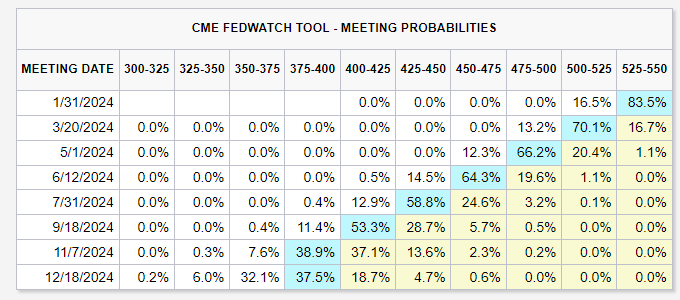

Yesterday, Jay Powell shocked the world by declaring three rate cuts in 2024! It was Fed speak of the most unusual order – open and transparent, instead of the opaque mumbling of previous chairmen.

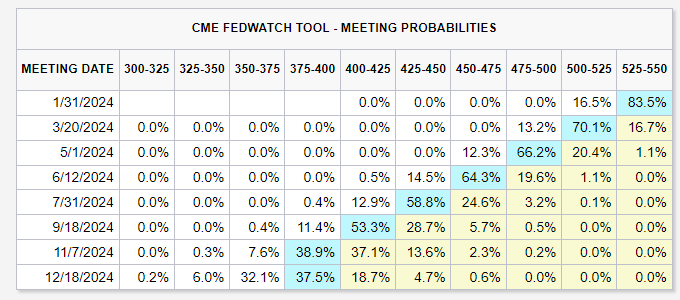

The predictions are for rate cuts early in 2024 too. The CNBC survey showed a 90% probability of a rate cut at the Fed’s March meeting, and 100% chance at the May meeting. This Fedwatch Tool below thinks they will all be in the first half of 2024:

What does it mean for the 2024 Spring Selling Season?

Real estate prognostications are usually wild guesses without any supporting data. But next year looks more predictable than ever – and we’ll be able to track it closely.

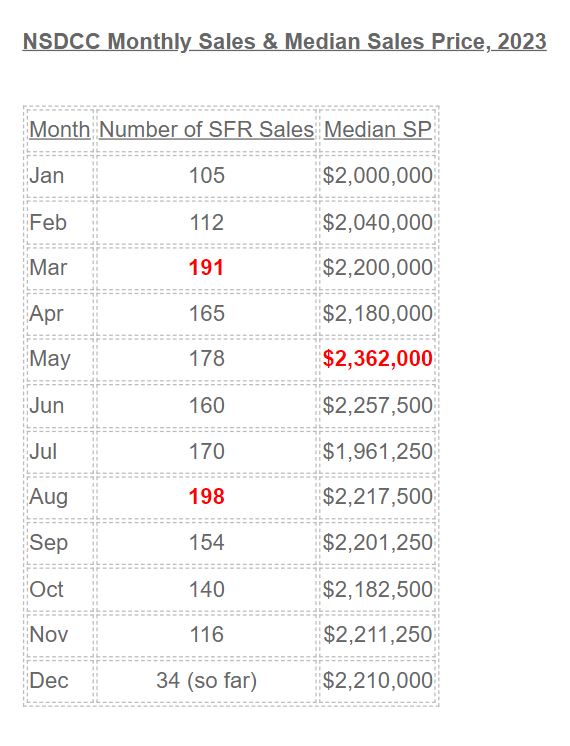

Let’s consider how 2023 played out:

In June, I mentioned that 2023 got off to a very fast start, and that March would have the highest sales count of the year – which means buyers and sellers were active in January and February!

We had a mid-summer surge too, and the August sales beat out those in March by a nose.

Because the price points are so much higher these days, every property is a luxury home that appeals to the affluent. It means the homes for sale need to be spruced up more than ever, which takes planning and preparation for weeks and months.

We already know that our team will be listing homes for sale on January 18th and 25th, and there should be many more others doing the same. With the 2023 inventory being so bleak, the pent-up buyers will be noting the lower mortgage rates and be on the prowl early.

We will do our annual January inventory contest to give everyone a feel for how the number of homes for sale is breaking early in 2024. Between the number of January listings and the results of our listings, you’ll have quality data on how the 2024 market is unfolding!

My guess is that there will be 10% more listings in January, and combining that with lower mortgage rates could set off a mini-frenzy!

Pricing was steady this year, and it should bump around by the same +/-5% in 2024. It’s probably not worth it to try to predict your purchase or sale by the price history – it will bounce around just because the metric is flawed.

by Jim the Realtor | Dec 8, 2023 | Jim's Take on the Market |