by Jim the Realtor | Dec 4, 2023 | Inventory

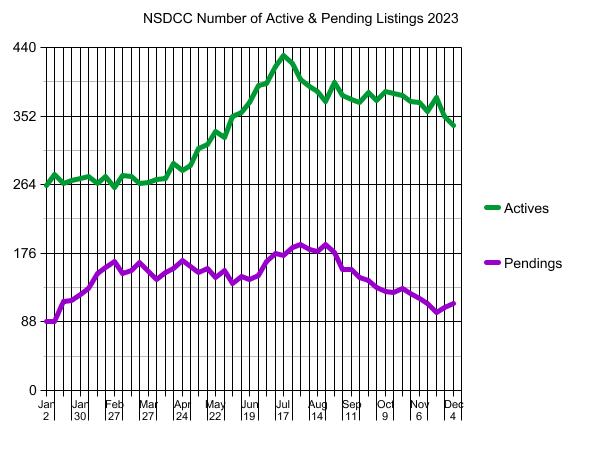

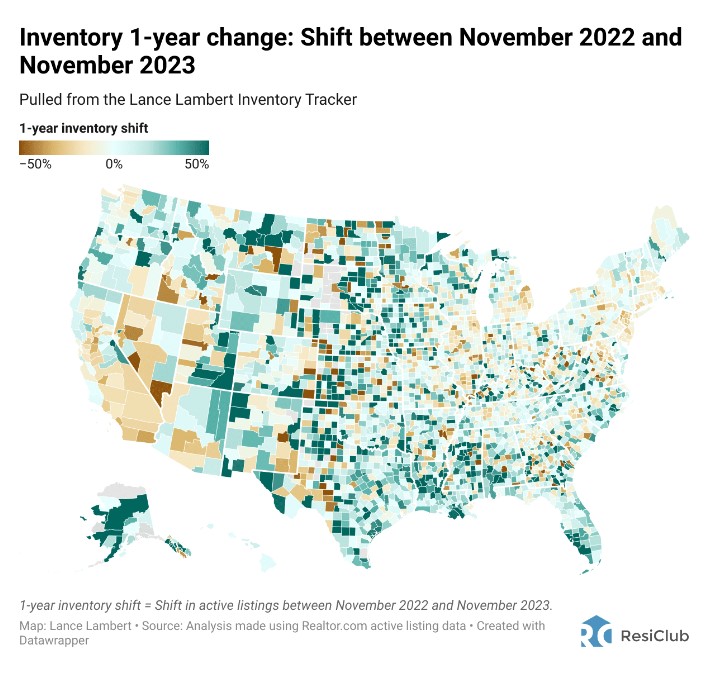

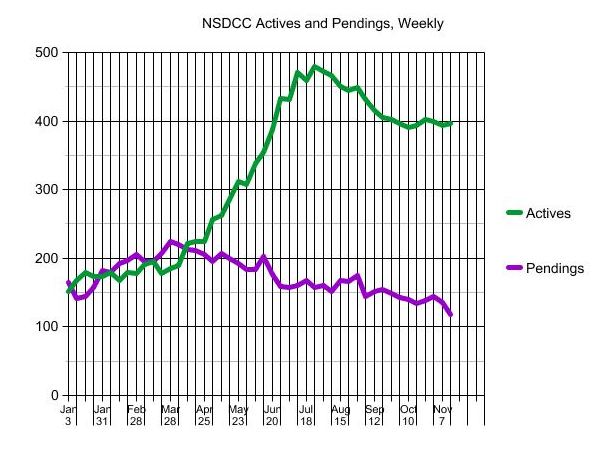

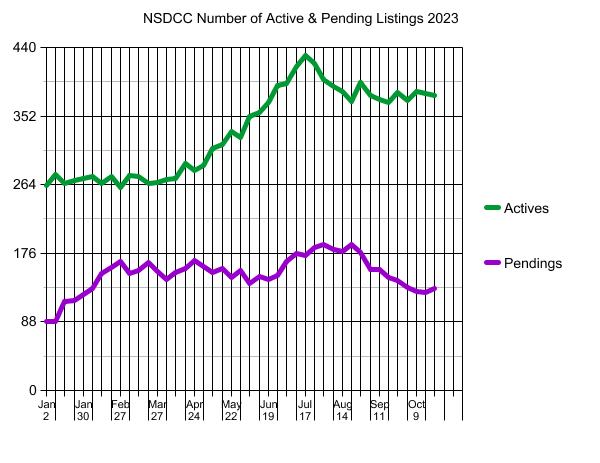

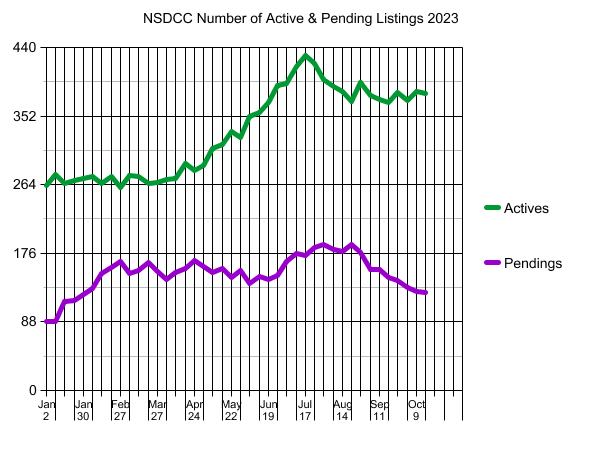

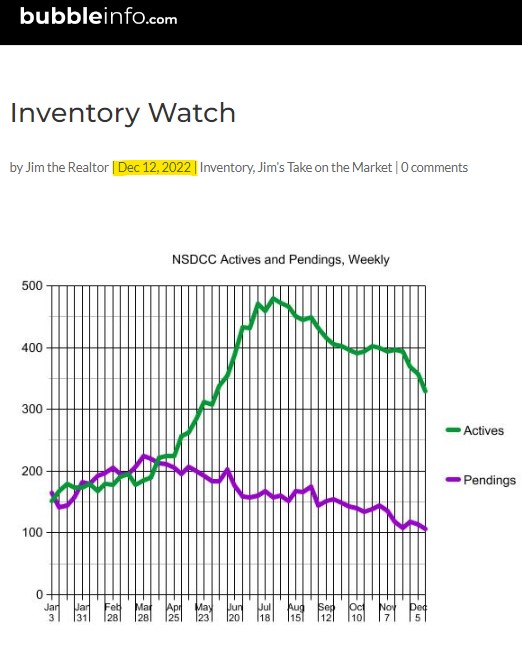

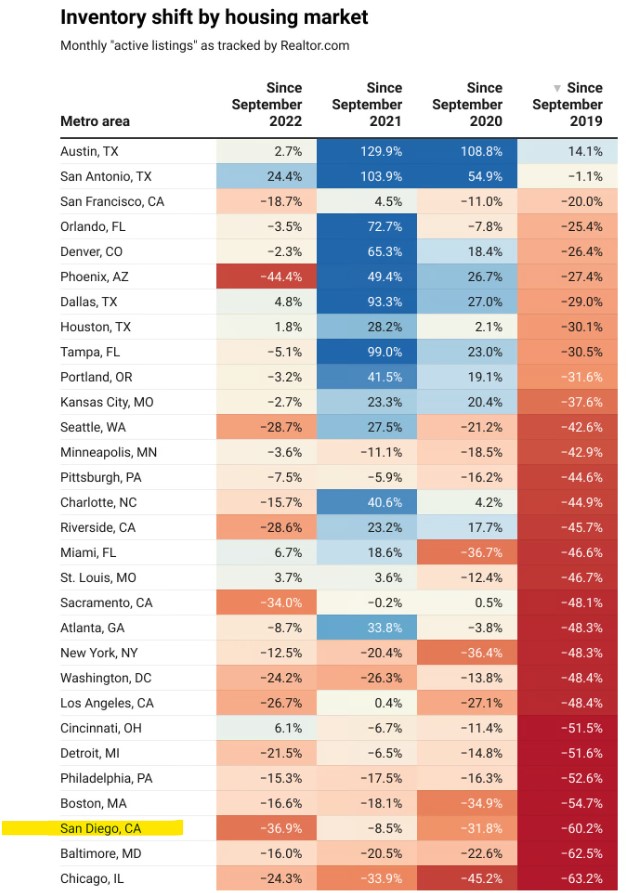

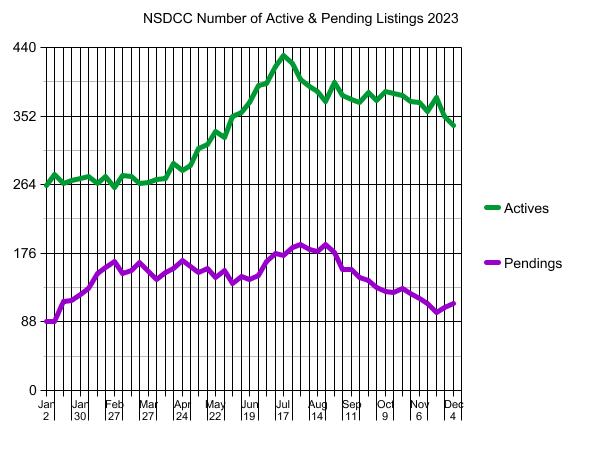

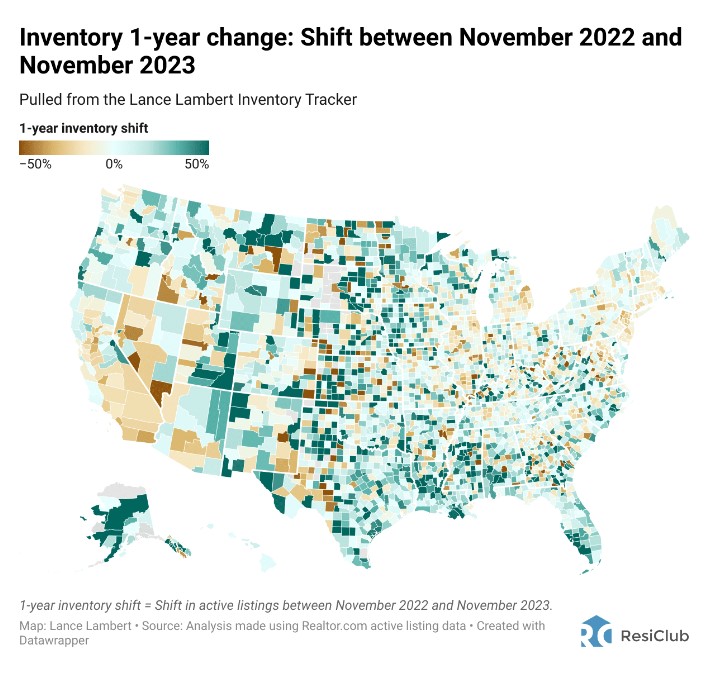

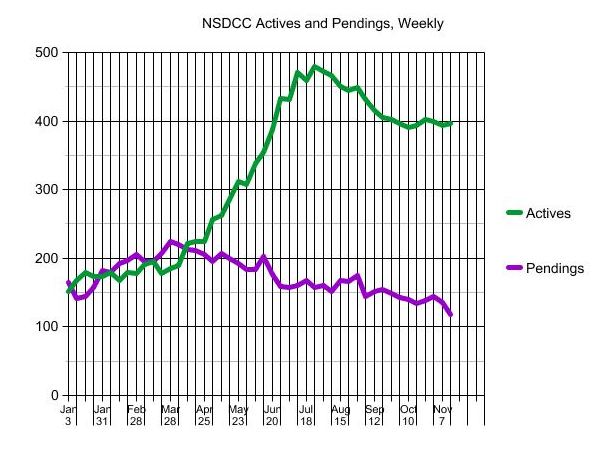

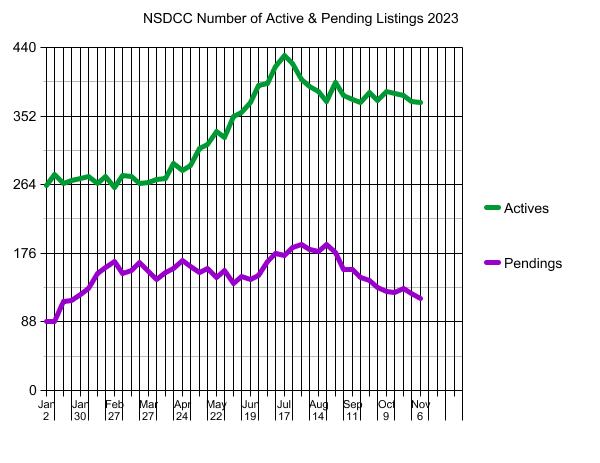

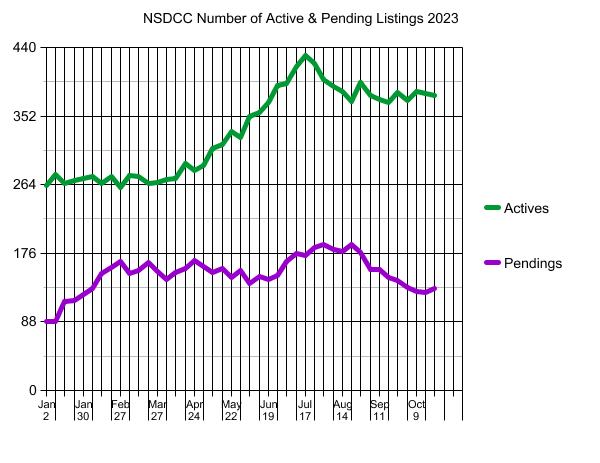

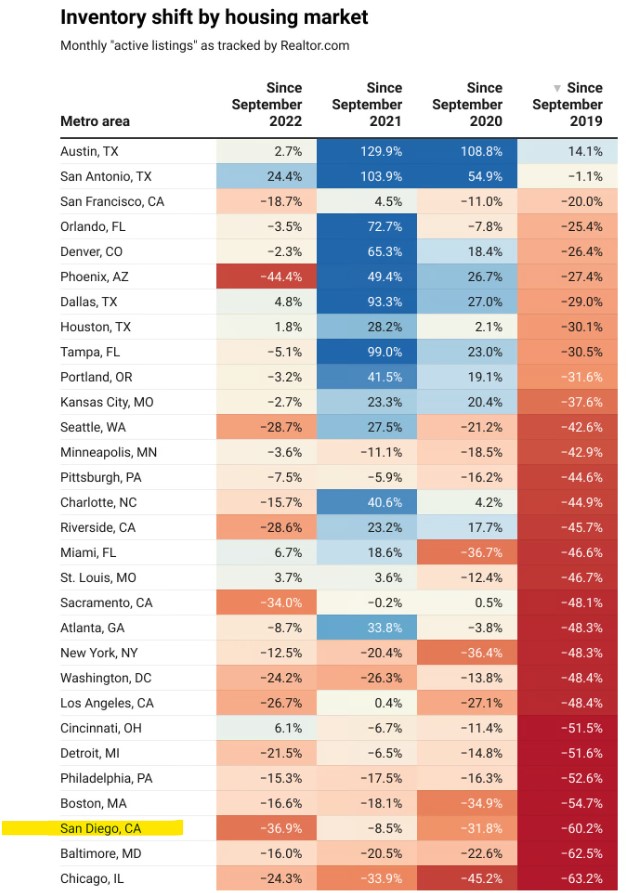

Last week, I speculated whether we will see a nice increase next year in the number of homes for sale. Rising inventory has been happening around the country….but not here, at least not yet:

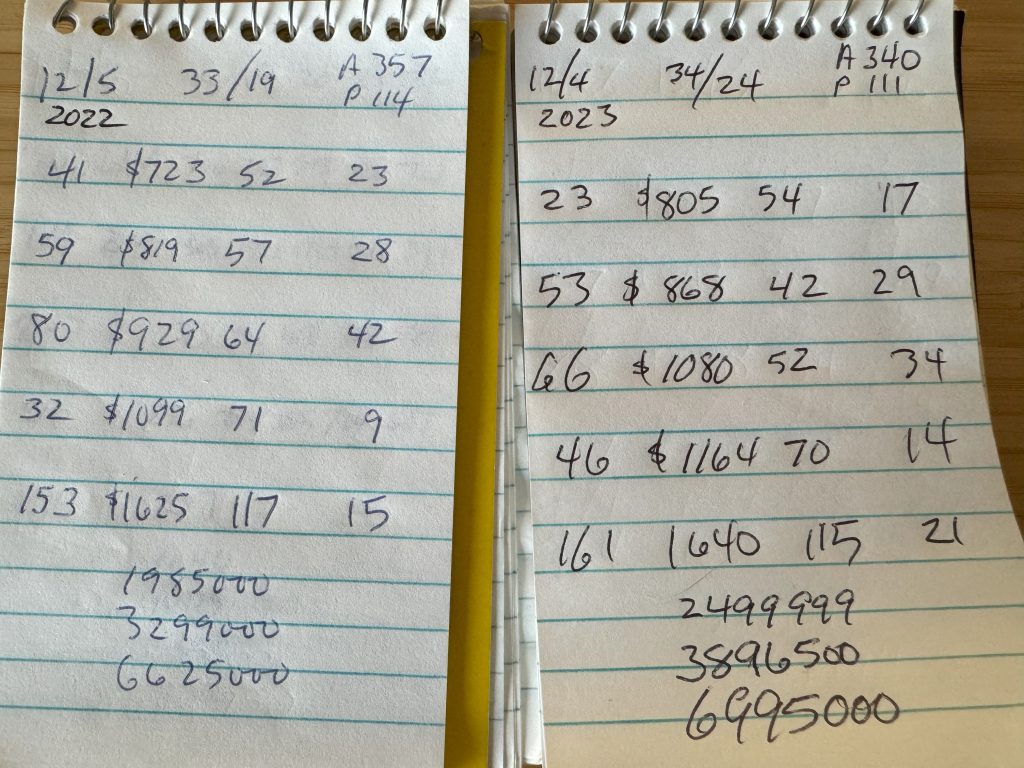

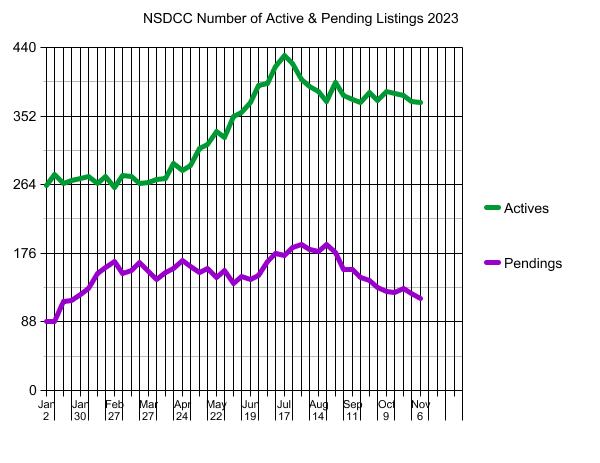

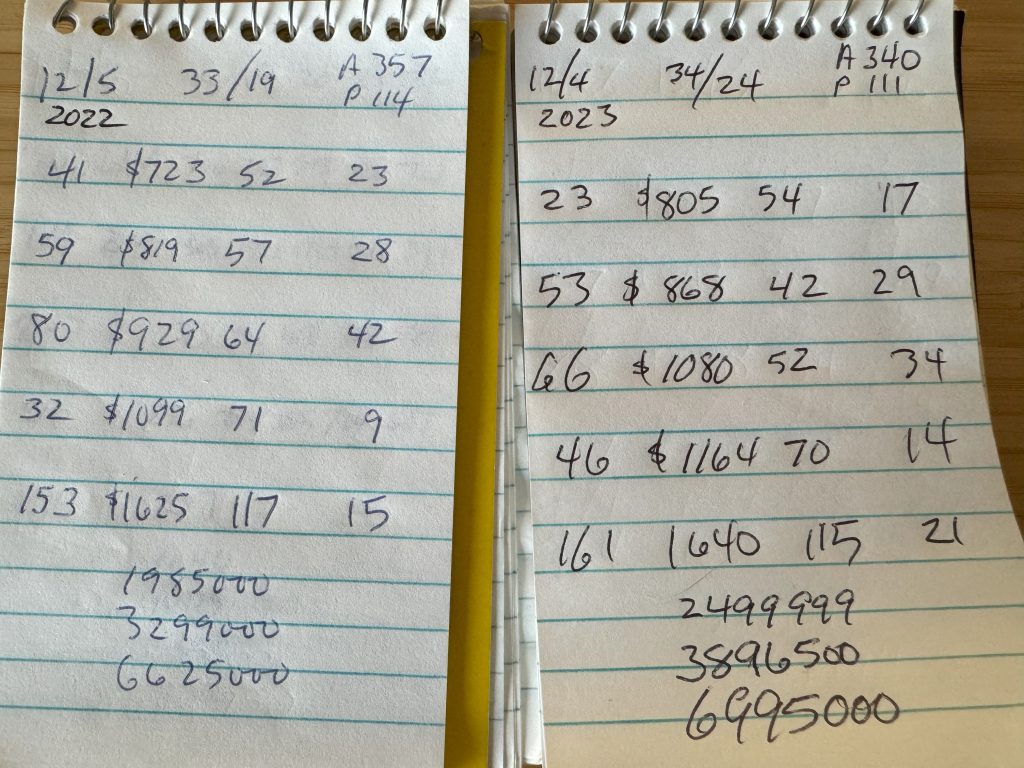

But the NSDCC market today looks a lot like it did last year, which suggests we might have similar results. I keep notes every week, and this is how my five price categories (O-$1.5M, $1.5-$2.0M, $2.0-$3.0M, $3.0-$4.0M, and $4.0M+) and the quartiles compare YoY:

As much as it seems that we’re overdue for more inventory, we probably won’t get it.

(more…)

by Jim the Realtor | Nov 29, 2023 | Inventory, Jim's Take on the Market, Market Surge, North County Coastal |

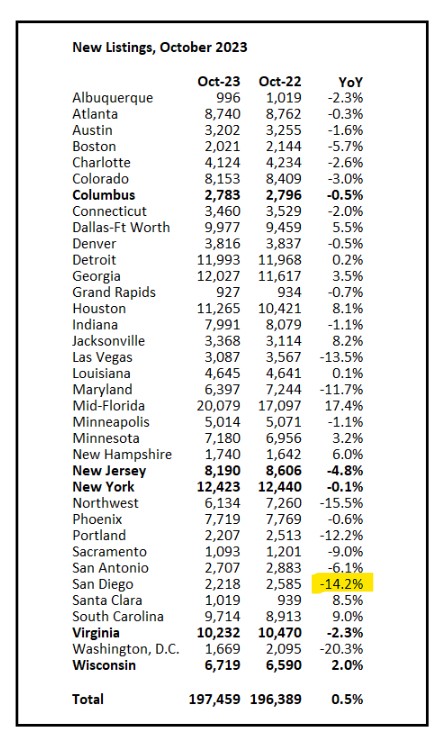

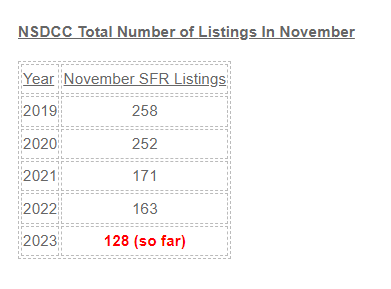

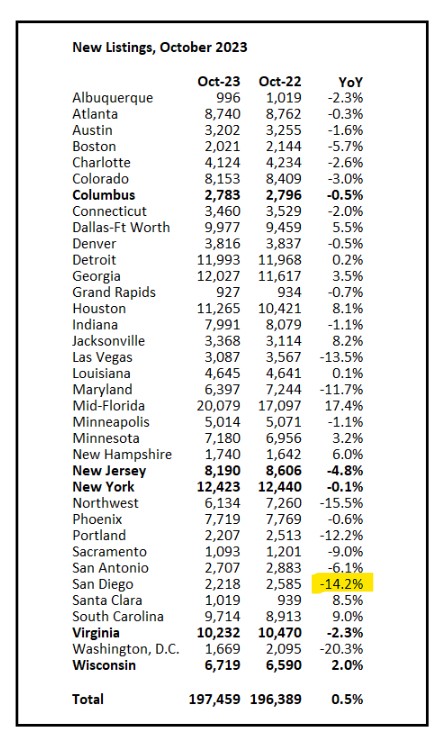

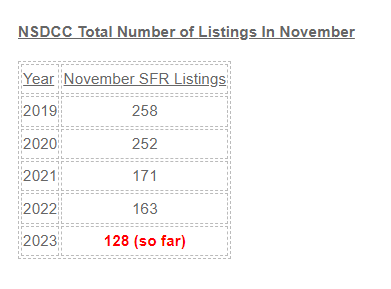

While a surge in inventory next year would help to change the market dynamics, there isn’t any hard evidence of it happening yet:

How many would be considered a surge? If the number of new listings rose 10% or even 20%, would anyone notice? Probably not.

Using these November numbers, and adding an extra 20% would only get us back to last year’s total – which we thought was bleak then. but now I’d take it!

It would take a real bump to get buyers to step back and say, ‘hold on, I’m going to wait and see where this goes for a month or two’.

Let’s guess that it would take at least a 25% increase in new listings for buyers to pause.

I was asking around yesterday, but nobody had anything definite to report about their new-listings flow for next year. One agent thought that we’re going to see a lot of short sales though (???).

by Jim the Realtor | Nov 27, 2023 | Inventory |

The local market will wind up the year with the lowest number of annual listings ever, the fewest number of annual sales ever, the highest prices ever (the latest Case-Shiller Index released tomorrow), and we’ll enter the new year with the fewest number of active listings ever.

What’s the worst thing that could happen?

We keep sliding into the Priced-To-Sit program, where sellers are happy for the market to come up to their aspirational price. It’s a strategy that was perfected in Rancho Santa Fe, where before the pandemic the actives-to-pendings ratio ran 10:1, and sellers just waited until their day came.

I’ll never forget the one RSF listing agent who took great pride in telling me that her one-year anniversary of her listing being on the market was coming up the following week. She was proud of her endurance and willingness to hold out until the ‘right buyer’ came along.

Interestingly, it was in 2012 that we had the lowest annual number of listings, and the following year got frenzied when the number of listings popped up by seven percent. There were other contributing factors to the resurgence, and our recent history is probably the exact opposite of then (years of real estate prosperity now vs. years of doom then).

Best-case scenario?

We get a 10% surge in new listings that aren’t priced ridiculously, and buyers keep buying – causing momentum to build through the selling season and give everyone assurance that it’s going to be alright.

(more…)

by Jim the Realtor | Nov 20, 2023 | Inventory |

Historically, when home prices went up, more people would list their house for sale to cash in.

But now it’s the opposite:

NSDCC Number of Detached-Home Listings Jan 1 to Oct 31

| Year |

# of Listings |

% YoY diff |

Median LP |

% YoY diff |

| 2018 |

4,404 |

– |

$1,499,000 |

– |

| 2019 |

4,341 |

-1% |

$1,579,000 |

+5% |

| 2020 |

4,134 |

-5% |

$1,695,000 |

+7% |

| 2021 |

3,498 |

-15% |

$1,927,000 |

+14% |

| 2022 |

2,768 |

-21% |

$2,350,000 |

+22% |

| 2023 |

2,312 |

-16% |

$2,489,000 |

+6% |

If pricing flattens out here, it would really cause a tizzy because sellers keep adding extra mustard to their list price. They would be disappointed next year – and create a potential for unsold listings to stack up earlier.

But this year’s total number of listings is still 48% below those in 2018, so if there were 10% more listings lying around, would anyone notice? Probably not.

(more…)

by Jim the Realtor | Nov 13, 2023 | Inventory |

The percentage change in Active Listings between the first week of October and mid-November:

2018: -3%

2019: -11%

2020: -12%

2021: -18%

2022: -0-

2023: -4%

It looks like the sellers are hanging around a while longer to see if November might be their lucky month. Only 16 listings went pending since last Monday (current count is 112 pendings), and there have been 39 closings this month.

It’s probably going to stay fairly quiet the rest of the year because sellers aren’t sensing any reason to panic, and they can see the 2024 Selling Season from here.

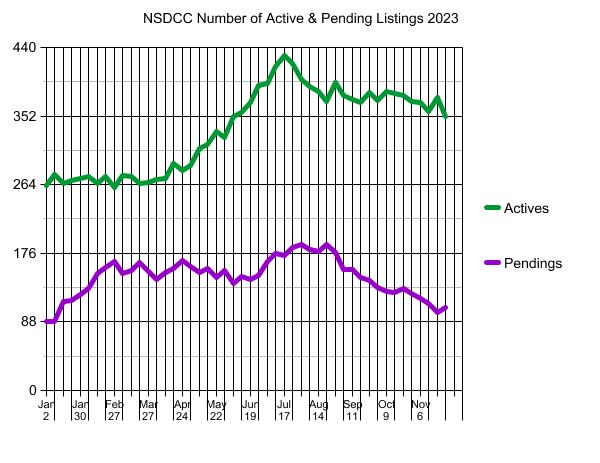

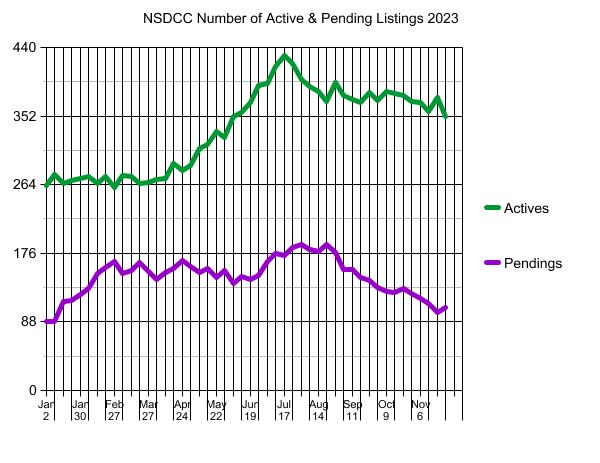

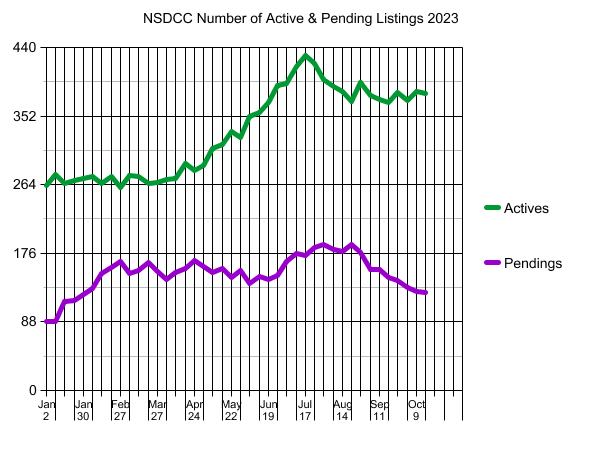

This is the same graph from November 14, 2022 – the late-summer surge of pendings was better this year:

(more…)

by Jim the Realtor | Nov 6, 2023 | Inventory

Though the industry is reeling from the controversial lawsuit verdict last week, new listings and new sales keep happening every day – people want and need to move, thankfully.

We are too close to the end of the year to have any violent swings in the market. Anything that happens from now on will be blamed on the holidays. Thanksgiving is only 17 days away!

(more…)

by Jim the Realtor | Oct 30, 2023 | Inventory |

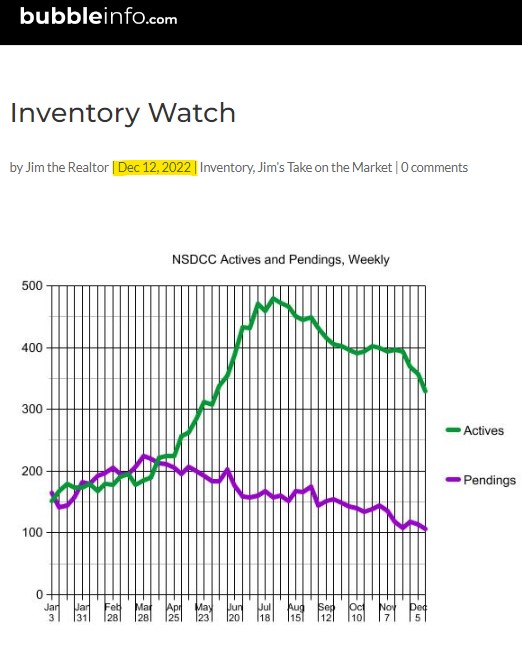

How does the current inventory of homes for sale compare to previous counts?

NSDCC Active Inventory, Last Week of October:

2016: 962

2017: 805

2018: 1,000

2019: 909

2020: 590

2021: 277

2022: 399

2023: 371

They say you can’t predict the future, but let’s give it a go.

The NSDCC inventory at the end of next October will be between 300-1,000. Based on higher rates and recent history, there will probably be around 400 houses for sale again.

The rates aren’t going to change. The ultra-low inventory isn’t going to change, especially if potential home sellers hear that the market is “bad” for selling. There will be occasional deals, just like this year but you’ll have to dig them out – they won’t be lying around.

Next year is going to look a lot like this year.

(more…)

by Jim the Realtor | Oct 23, 2023 | Inventory

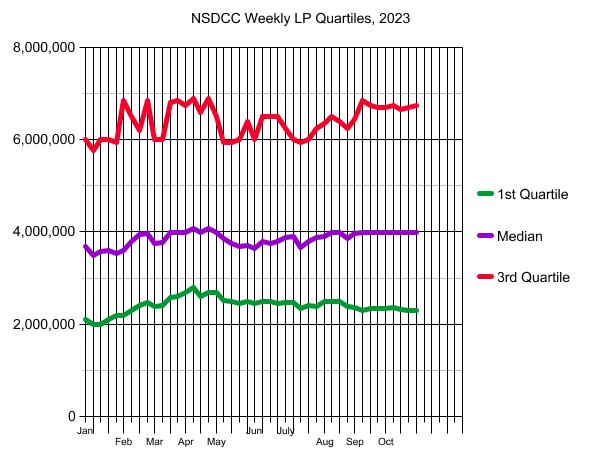

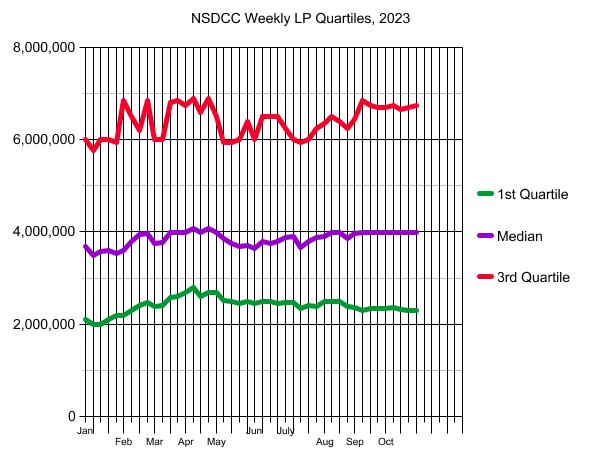

The NSDCC median list price has been around $3,995,000 all year, and has been stuck there for the last three months.

Homes listed above $4,000,000 tend to be custom homes which are harder to price, and their sellers tend to be more affluent and will want to test the market. Let’s don’t assume anything from them about the overall market conditions – if those houses don’t sell, it probably won’t change the sellers’ lifestyle much.

Let’s form our opinions about the health of the current market conditions from the Under-$4,000,000 category:

Given all the commotion, the Under-$4,000,000 market looks fantastic!

(more…)

by Jim the Realtor | Oct 16, 2023 | Forecasts, Inventory, Jim's Take on the Market |

Recently the president of the local association of realtors was asked what the real estate market will do in the future. His response: “Nobody knows what the market is going to do in the future”. Of course, immediately after that comment he said, “Interest rates have to drop to 5.5%. Then you’ll see everyone get excited and say, ‘Hey, let’s sell our house and get another one.'”

Even if mortgage rates to go back to 5.5%, people are living in their forever home. The difficulty of finding a better home for a decent price will overwhelm any minor inconvenience at their existing home.

I don’t mind predicting the future. The rest of 2023 is going to look a lot like it did last year:

Next year, the inventory should grow quickly in the April-July time frame. Price will fix everything else!

(more…)

by Jim the Realtor | Oct 13, 2023 | Inventory, Jim's Take on the Market, Why You Should List With Jim

We have plunging sales mostly due to plunging inventory!

The supply and demand has plunged at the same time, and there is no way to know that if the inventory were to grow, would there be enough buyers to soak it up? Today’s inventory is full of the leftovers that didn’t sell during summer (today’s average DOM among NSDCC active listings is 77 days), so we can’t really judge it correctly now. But if you see homes that look good and are priced attractively but aren’t selling, then you know the tide might be turning.