by Jim the Realtor | Jul 2, 2022 | Ideas/Solutions, Market Conditions |

These are excerpts from Scott G’s newsletter yesterday:

The most recent migration headlines concern Silicon Valley. The narrative: It sucks and everyone is leaving. Venture capitalists who built their fortunes in the Valley say they’re “over” it. The Bay Area is “crashing” and has become “unhinged” with wokeness. “San Francisco is Detroit and Miami is the future,” claimed a recent VC transplant. Elon Musk relocated Tesla from California to Texas, saying California state laws were “fascist.” Newspapers across the country report on a “tech exodus,” with quotes and anecdotes from aggrieved tech workers. California’s dead. (So is New York.) Tech’s moving to Texas and Florida, and the money will follow.

We’ve been to this movie before — it’s called bullshit. In 2005, Silicon Valley was losing its edge and hemorrhaging jobs. In 2009 it was shrinking, on the brink of death. In 2010 it was on the brink of death again. In 2012 the Golden Age of the Valley was over. In 2014, San Francisco was declared the next Detroit. However, the next Detroit has HQs within a 15 mile radius whose combined market caps rival the GDP of Germany and Japan combined. I know, apples/oranges … both are fruit. You get the idea.

Ninety-seven percent of startups stayed in the Bay Area in 2020. Of the 1.2% that moved, a fifth went somewhere else in California, and another fifth went to New York. The Valley still dominates the startup scene. Last year firms domiciled in the Bay Area received over a third of total U.S. venture capital funding. Austin and Miami received 1.5% and 1.4%, respectively — less than Seattle, Philadelphia, or D.C. I don’t believe a city can sustain a robust technology sector unless it has a world-class engineering school (e.g., Berkeley, Stanford, etc.). Also, declining quality of life and overwhelmed infrastructure is an apt descriptor of … Miami. And Miami’s population actually declined in 2021.

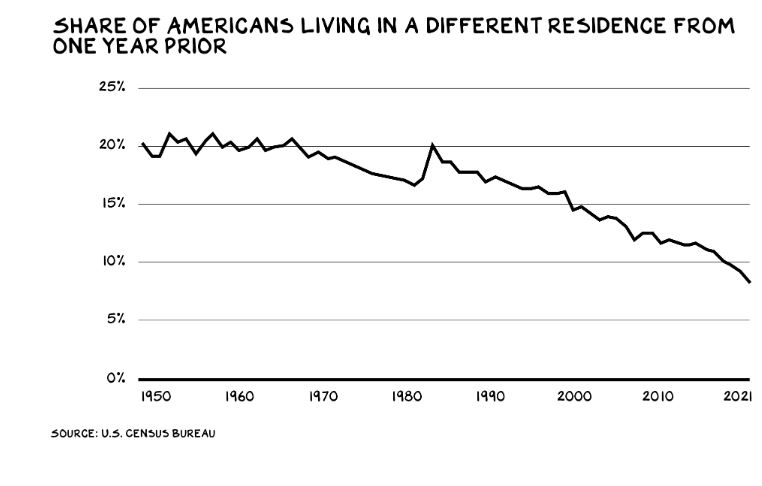

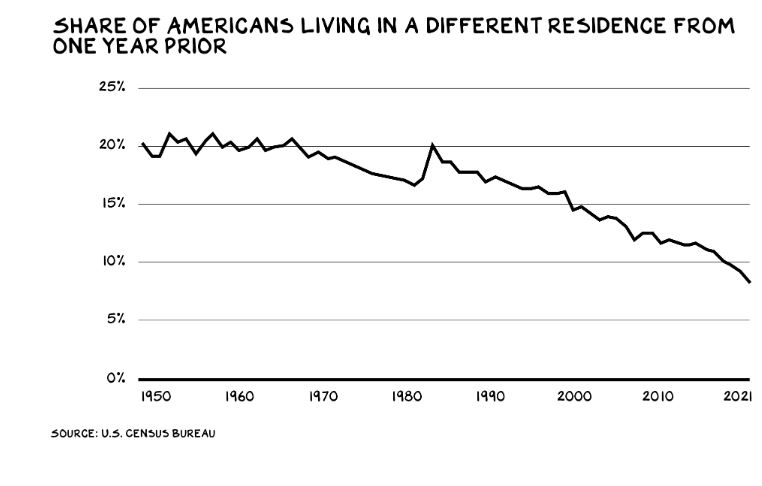

The tech exodus narrative is a distraction. The real domestic migration trend is…..less migration. Specifically, people aren’t moving. In 1948 roughly a fifth of Americans changed residences. That number has been steadily declining since. During the pandemic, we read opinion pieces about everyone quitting their job and moving to Maine. There was a feeling that migration habits were changing; in reality the song remains (increasingly) the same. In 2021, only 8.4% of Americans moved — an all-time low.

It’s been happening for several decades, though nobody can figure out why. An aging population and a younger cohort described as the “complacent generation” are factors, but there must be more. Lack of portable health care and a decline in the lifestyle once sought in the West could also be explainers. My theory is that, like everything else, mobility has become a luxury item costs can only be borne by college grads (who are themselves increasingly anchored by student loan debt).

The problem isn’t that a tech Karen is leaving the Bay Area, it’s that not enough people are leaving any area. “Remote Work” should be called “Work from Home” as it’s decreasingly remote, just at home. Six in 10 people who move stay within their county; eight in 10 stay in-state.

by Jim the Realtor | Jun 29, 2022 | Ideas/Solutions, Thinking of Buying? |

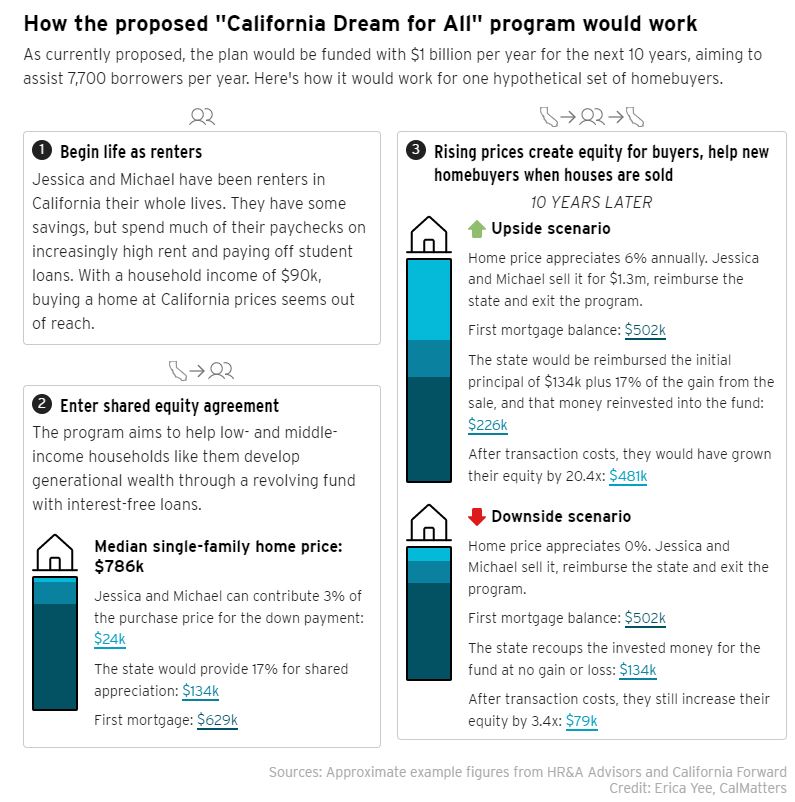

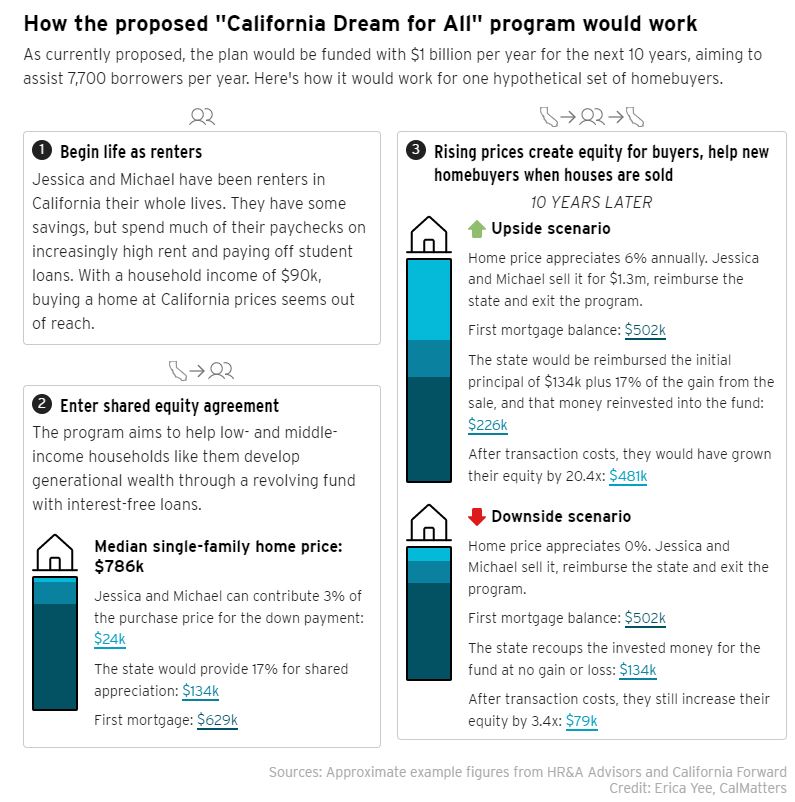

More on one of the proposals to spend the state’s budget surplus. It doesn’t make the homes any cheaper, so home buying will still be limited to the affluent who can afford the payments:

First-time buyers often rely on family gifts to afford the down payments on their homes. Now California Legislators want the government to fill the role of generous relative.

Lawmakers are proposing creating a billion-dollar fund in this year’s state budget that would provide California’s first-time buyers either all of the money they need for a down payment, or very close to it, in exchange for partial ownership stakes in those residences.

Atkins said the California Dream for All program is aimed at creating opportunities for lower- and middle-income buyers in a rapidly rising market, including those who have faced racial and economic barriers to homeownership.

“The California Dream for All program will give more people the chance to break free from the cycle of renting,” Atkins said last month. “This has the ability to change people’s lives.”

The proposal is the subject of negotiations between the Legislature’s Democratic supermajority and Gov. Gavin Newsom, also a Democrat, on how to spend a projected budget surplus of $97.5 billion. The legislature passed a budget on Monday that includes the proposal, though negotiations with Newsom continue on a final overall spending plan.

A spokesman for the governor declined to comment on the proposal, citing the ongoing negotiations. It was not included in the governor’s original budget nor in his May revised budget.

The housing proposal – which would call for issuing revenue bonds of $1 billion a year for 10 years to create the fund — is the largest in a slew of proposals intended to promote homeownership this year. The proposal also includes $50 million in the budget this year, and $150 million per year after that to pay for the administrative costs of the program and the interest costs of the revenue bonds.

The program envisions helping some 7,700 borrowers a year, according to estimates made by the program’s designers based on home price projections. A start date for the proposed program has not been indicated.

Read the full article here:

https://calmatters.org/california-divide/2022/06/california-down-payment-help/

by Jim the Realtor | Jun 24, 2022 | Auctions, Frenzy, Ideas/Solutions |

It would have been a good idea to launch the auction format on an industry-wide basis during the frenzy. But how about now? They are still a good idea because auctions bring transparency and certainty to the home-buying process, which buyers would appreciate and make them more likely to engage. Excerpts from article linked below:

If a home has been listed for a long time without much interest, it may be overpriced, according to Mr. Lesnock. During the pandemic, heightened demand has created bidding wars among buyers, with some prime properties selling within days of listing. If a residence isn’t getting any traction in one of the hottest real estate markets of the modern era, there’s a problem.

“Why is it not selling? It’s the windiest day on record, why is this kite not flying, right? That’s the way to think about it,” Mr. Lesnock explained.

The auction process also allows more transparency, according to Mr. Pchelintsev. Both buyers and sellers can follow the bids, either at a live auction or, increasingly, online.

“You get a notification on your phone. Someone just made a bid bigger than you, and you go, ‘how dare you?’” he said. “You go on and place a bigger bid and now you’re basically, apart from trying to get this amazing house, you’re also In sort of a little bit of a competition.”

That competition can help drive up the price of the property, according to Randy Haddaway, CEO and founder of Naples, Florida-based Elite Auctions.

“Sellers get more through this process than they would otherwise,” he said. “You get a group of millionaires competing against each other—and none of them are used to losing. They don’t want to walk away and that drives up prices.”

Mr. Lesnock agreed. “If you do [an auction] correctly, it will generate fair market or better prices.”

Link to Full Article

by Jim the Realtor | May 16, 2022 | Ideas/Solutions, Military |

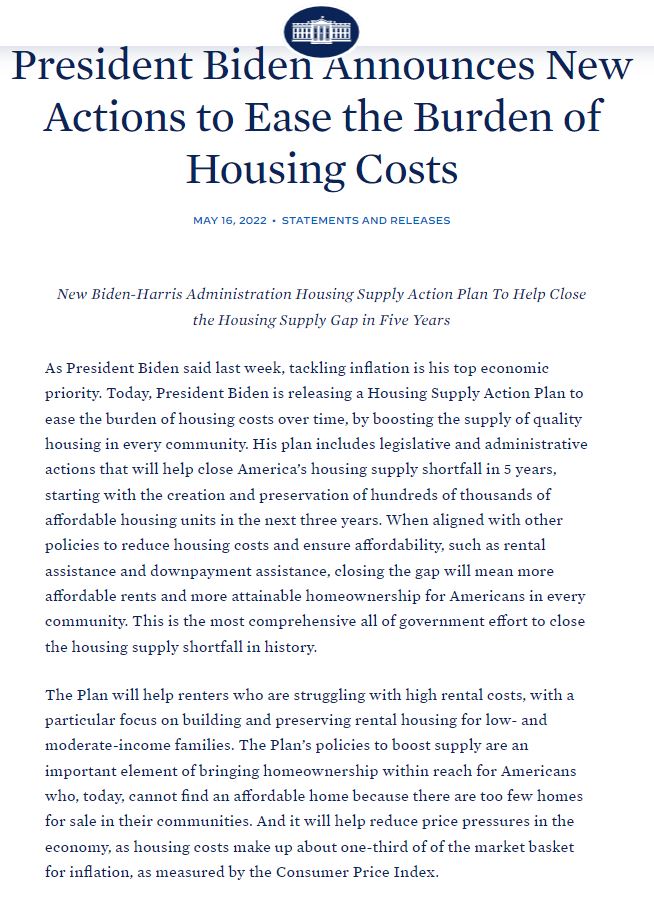

Today, the White House released their plan to fix housing:

https://www.whitehouse.gov/briefing-room/statements-releases/2022/05/16/president-biden-announces-new-actions-to-ease-the-burden-of-housing-costs/

I only skimmed it and I didn’t see the one thing that could really make a difference, which is re-purposing federally-owned real estate for residential use.

Let’s start with MCAS Miramar, which is 23,116 acres in the middle of San Diego that would be ideal for residential development. It’s big enough that you could have something for everybody!

We had our chance once:

In 1954, the Navy offered NAS Miramar to San Diego for $1 and the city considered using the base to relocate its airport. But it was deemed at the time to be too far away from most residents and the offer was declined.

Let’s leave the airport where it is and redevelop Miramar!

https://en.wikipedia.org/wiki/Marine_Corps_Air_Station_Miramar

by Jim the Realtor | May 12, 2022 | Ideas/Solutions, Thinking of Buying? |

This will help to keep home prices up:

A top California lawmaker is proposing to spend $10 billion to help families buy homes in the state with some of America’s highest housing prices.

Democratic State Senate Leader Toni Atkins on Wednesday unveiled details of a proposal she’s pushing to create a revolving fund that would provide interest-free loans for up to 30% of the purchase price of a home for low- and middle-income households.

If implemented, it would be the largest program of its kind in the nation, according to the people who designed it. Proponents hope that it will be included in the state budget that must pass by June 15 and go into effect as soon as January. The aim is for it to eventually help about 8,000 families a year.

The proposal calls for the state government to share in any appreciation in the value of houses it helps purchase when they are sold and then invest those proceeds back into the fund.

“The purpose of this is to create a long-term endowment,” said Gene Slater, chairman of CSG Advisors, which advises public agencies on affordable housing and helped design the program. “We’re investing in the future value of the home so we can help other people.”

Under the proposal, California would spend $1 billion a year for 10 years. Participation would be limited to households making 150% of the median income in an area. There would be limits tied to a region’s median home price allowing home buyers in the most expensive markets such as the San Francisco Bay Area to benefit.

In Los Angeles County, households earning up to $120,000 a year could qualify for assistance, while in low-income areas like the agriculture-heavy Central Valley, that number would be closer to $107,000, according to data provided by the researchers who drafted the framework. Proponents want to target certain groups through outreach, including residents of largely Black and Latino neighborhoods and those with high loads of student debt.

The homeowner would repay the loan when they sell or refinance the home, along with a cut of the profit from any appreciation in value based on how much assistance the state provided. If the home price declines, Mr. Slater said, the state would be repaid if money is left over after the purchaser pays back their mortgage loan and recoups their portion of the down payment.

The program would be limited in scope to cover only about 2% of home sales volume statewide in an effort to avoid pushing prices higher.

Participants would be chosen on a first-come, first-served basis, with slots set aside for certain geographic areas and income brackets.

To become law, the proposal would have to pass both chambers of the Democratic-controlled state legislature and be approved by Democratic Gov. Gavin Newsom. A representative for Mr. Newsom declined to comment on the pending legislation. In a statement, Assembly Speaker Anthony Rendon praised Ms. Atkins’s work on the issue but didn’t say whether he supported her proposal.

An unlocked link to the full WSJ article:

https://www.wsj.com/articles/california-legislative-leader-wants-to-spend-10-billion-to-help-families-buy-homes-11652270401

by Jim the Realtor | Nov 3, 2021 | ibuyer, Ideas/Solutions, Zillow |

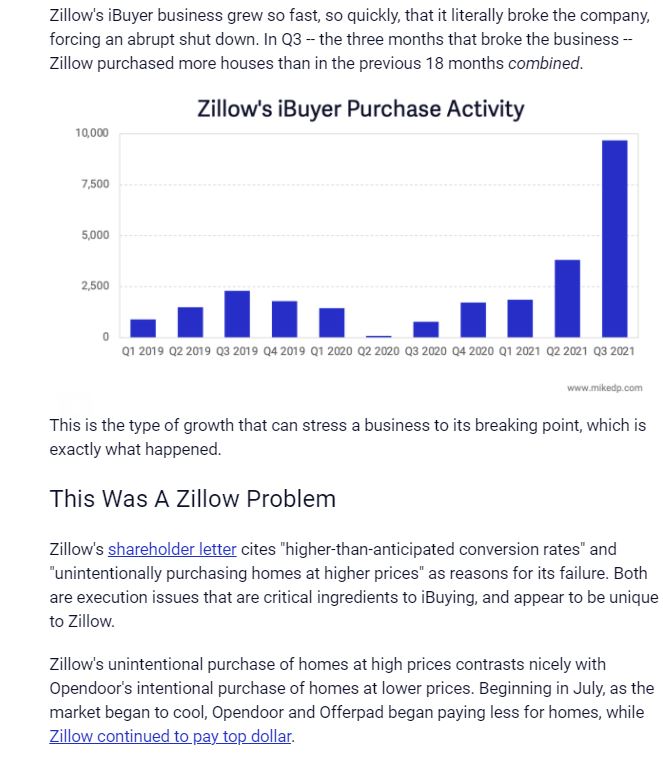

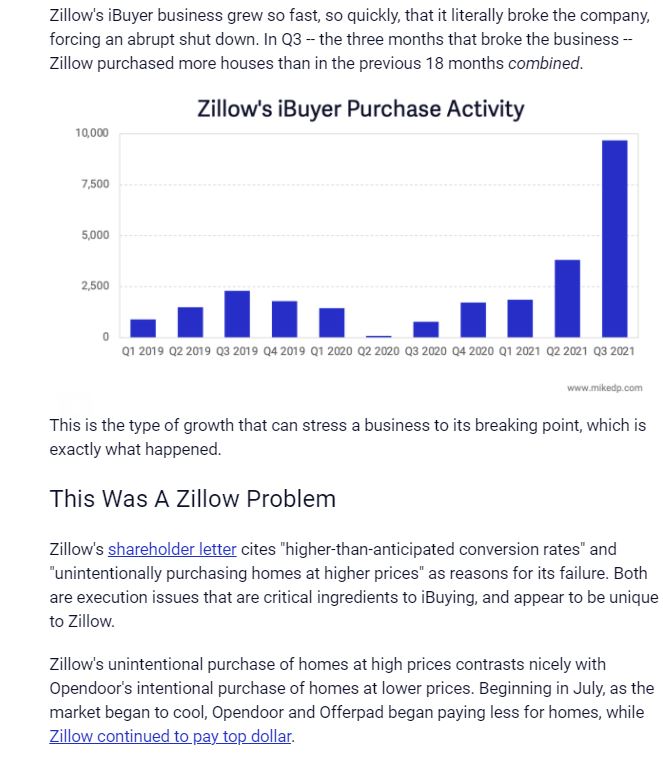

Mike pointed out that Zillow simply kept paying too much for homes, and instead of adjusting on purchase prices being offered, they shut it down yesterday.

But Zillow is too big and too aggressive to rest.

Here’s what Mike thinks could be next:

While Zillow 2.0 may have been a failed experiment in iBuying, what captures the imagination is the next iteration of the business. How will Zillow leverage its massive competitive advantage and its iBuyer learnings for Zillow 3.0?

I wouldn’t be surprised to see Zillow play deeper in the Power Buyer space, a model that is asset-light, easier to scale, less risky with better unit economics, and has a natural overlap with Zillow Home Loans (Opendoor diversified into Power Buying earlier this year).

Zillow as a Power Buyer — either through organic development, partnership, or acquisition — is a natural extension to its existing business of helping home buyers. The world of real estate has evolved significantly since 2018, and Zillow needs to stay relevant to those evolving consumer needs.

It would be a smart move. The buyer side is where the help is needed.

Assisting buyers with making all-cash offers is a very attractive service, with no real downside because all they have to do is funnel the business into their mortgage company to refinance the purchases after the fact. They could flip these buyers to their Premier Agents too – a group who is wondering if it’s worth it to be a Zillow customer today.

The supply and demand will be out of balance for years to come, and buyers are the ones that really need the help. Go Zillow!

www.mikedp.com

by Jim the Realtor | Jun 6, 2020 | Carlsbad, Ideas/Solutions, Jim's Take on the Market, Local Flavor |

Here are ways to contribute to the creation of reasonably-priced housing:

The San Diego Habitat for Humanity ReStores are home improvement discount stores with a simple premise: by selling new and gently used donated goods, we can fund the construction of new Habitat homes in San Diego County.

Home products are sold to the public at 30-70% below retail prices. The ReStore offers mostly brand-new furniture and home goods from stores like Restoration Hardware and Wayfair, but there are also great deals on slightly used gear too. Shop ReStore online!

Clearing out your house? They gratefully accept donations of items in good-working condition, such as appliances, furniture, tile, lighting, windows, cabinets, tools, and more. Please click here for a full list of acceptable items. Or call them at 619-241-2221 or send an email at dispatch@sandiegohabitat.org and they’ll be happy to answer your questions!

Are you looking for stuff like doors, windows, appliances, etc.? Check the Escondido store. The Carlsbad store is primarily furniture and home goods.

Donate money for the cause – click here: $$$$

The ‘about’ page:

https://www.sandiegohabitat.org/ReStore/About-the-ReStore

(more…)

by Jim the Realtor | Dec 12, 2019 | Ideas/Solutions, Jim's Take on the Market, Local Flavor |

Thanks to the OCR for this article – link at bottom:

Sounding the latest alarm over the devastating impacts sea level rise is expected to have on the California coast, a new report from the state Legislative Analyst’s Office details the critical need for action over the next decade and notes that most preparations so far are only in beginning stages.

Between $8 billion and $10 billion of existing property will be underwater by 2050 and another $6 billion to $10 billion will be at risk at high tide, according to a study cited in the report.

“The certainty of rising seas poses a serious and costly threat,” according to the Legislative Analyst’s Office, a nonpartisan governmental agency that provides policy advice to the state Legislature.

For every dollar spent preparing in advance of disasters, $6 in post-disaster losses are avoided, according to a federal study cited by the Legislative Analyst’s Office. With the state estimating a half-foot or more of sea level rise by 2030 — and as much as 7 feet by 2100 — the report says it’s crucial to take extensive measures over the next 10 years or so.

(more…)

by Jim the Realtor | Apr 1, 2019 | Documentary Film, Ideas/Solutions, Jim's Take on the Market, Local Flavor, Local Government, Market Conditions, NIMBY |

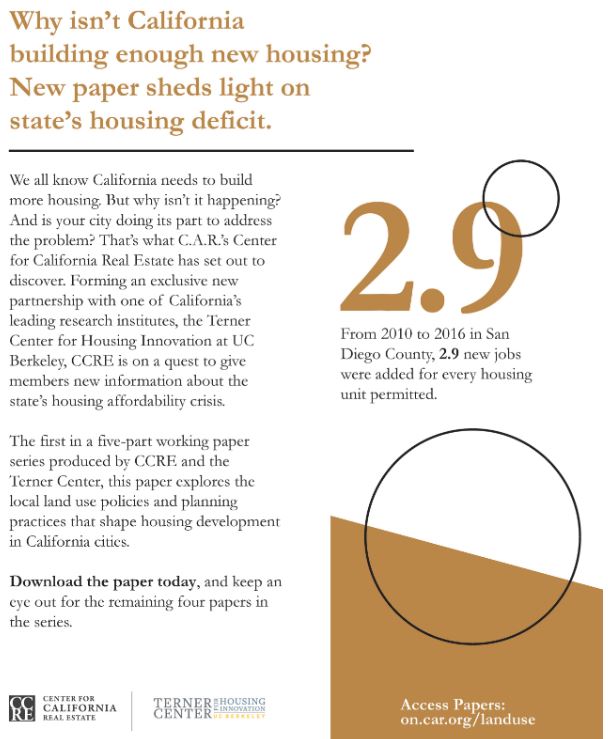

The C.A.R. sent out this paper that reviews the current housing dilemma, which boils down to having to improve zoning regulations to facilitate more/better infill projects because the more-mature cities are out of land for the most part. She also included this:

However, the paper also offers evidence that cities can use their control over the development process to limit access to housing, sometimes in problematic ways. The finding that less housing is built in cities with both higher homeownership rates and White populations is sadly consistent with existing research on NIMBY opposition to local housing development (Lewis & Baldassare, 2010; Scally & Tighe, 2015; Whittemore & BenDor, 2018). These studies examined opposition to building multifamily or affordable housing; it is striking that in this study cities with more homeowners and larger white populations had less single-family development. This finding serves as yet another warning that racial exclusion from White communities continues to limit housing opportunities for people of color.

Link to Full Report

by Jim the Realtor | Oct 25, 2018 | Homeless Cure, Ideas/Solutions, Jim's Take on the Market, Local Flavor, Local Government |

I love this idea – but $140,000 each? Hat tip Eddie89!

The region’s first housing project made from shipping containers could open as soon as April, providing homes for 21 formerly homeless veterans and possibly paving the way for hundreds of new affordable and median-priced homes in the near future.

The units are planned for a vacant lot at 2941 Imperial Ave. in Logan Heights. Each 320-square-foot unit would have its own patio, kitchen and bathroom. While the units will be built from metal shipping containers, they will be insulated and have interior drywalls.

(more…)