Coronavirus Flip

The first flip we’ve seen since the ‘rona hit. This listed for $899,000 on March 25th, and sold for $950,000:

The first flip we’ve seen since the ‘rona hit. This listed for $899,000 on March 25th, and sold for $950,000:

Josh came down from Beverly Hills to round-trip the Razor house, which had sold for $14,097,000 in 2011. It closed yesterday for $20,800,000.

The previous sale did have some hair on it:

Public documents show what the new owner paid is lower than liens on the home, which totaled about $22.7 million. Burns, who expressed interest in the home about seven months ago, initially offered more than $16 million but in October dropped it to $13.9 million. He won out with his new bid after negotiations that resulted in concessions from some of the lienholders.

Here’s a sample of Burns’ negotiating skills in an Oct. 20 letter addressing Leslie Gladstone, the trustee in the Cooksey bankruptcy case:

“This new offer is lower than my first offer because the lack of other qualified buyer offers over the last months of heavy advertising proved that my past offer was above the Fair Market Value of the property,” he said.

Burns continued to say: “The First Mortgage Holder (Bank of America) will need to ultimately decide if it wishes to own this property, or if they would like to achieve their maximum recovery now and be free of the expense and liability of owning a property that has been the white elephant for four years.”

A court record dated Dec. 7 shows Gladstone agreed with Burns’ argument on the distressed home.

“This immediate relief is appropriate because Bank of America will foreclose on the Property if the sale does not close prior to December 31, 2011,” said Jeffry A. Davis, attorney for Gladstone.

The property, the work of renowned San Diego architectural designer Wallace E. Cunningham, is unfinished and has never been occupied. The new owner plans to work with Cunningham to complete the design.

The seller did install a kitchen, and staged it nicely – and included the photo above which helped disclose a possible annoyance with the property/location – you get the paragliders flying by:

Here is the Visa commercial that featured the home:

Remember my listing in La Costa that closed in December? These are my ‘before’ photos above. The new owners have already turned it around and have it back on the market on the range $899,000 – $950,000. I don’t think they will have any trouble:

https://www.zillow.com/homedetails/7516-Brava-St-Carlsbad-CA-92009/16677014_zpid/

The ‘after’ video:

Brava closed yesterday, after a whirlwind of activity – here are the MLS stats:

We received 13 cash offers, and went through five escrows to get one to stick. Each time one would fall out, I went back to all of the other contenders to give them another chance to buy it.

Buyers would say that they had reviewed what’s needed (new kitchen, 3 bathrooms, windows, flooring, etc.), and were comfortable with the project.

Of the four that cancelled, three dropped out altogether once they did more extensive research.

Only one tied up the property, and then, after a few days, tried to work me down on price. They are looking for the desperate sellers and agents, and hope to convince you to drop another $20,000+ just get it over with.

It was Mr. T who tried to get me to cave, and he had agreed to pay $665,000. After further review, he wanted to drop the price down to $645,000.

But instead of just taking it, I went back around to all the other contenders and offered them another opportunity.

A different buyer agreed to pay $655,000, and Mr. T. held his ground, and backed out. But then the $655,000 guy cancelled, and in the next round Mr. T wanted to drop again, this time down to $635,000.

I got another buyer to do better.

We closed at $650,000.

It’s more work to keep all the contenders engaged, and keep tempting them to buy the house during our five-week adventure. But this is what I do for my sellers – I’m going to everything I can to get you that extra $15,000.

The buyers cancelled the second escrow on Brava yesterday.

We have had a dozen cash offers, so after the first cancellation I went back to the others and got them to bid it up to $690,000, which is a miracle when the highest offer was $675,000 in the first round.

Other agents since have said, ‘oh, you picked the wrong buyer’. But I’m going to give the high bidder a chance to close every time – I think I have that obligation. If they would have stuck, I would have been a hero.

There is more of a chance that end users will hang in there, but with flippers it tends to be cut-and-dry, and all about the money. There has been some concern about the 2019 market being soft(er), but it’s not stopping them from wanting to buy. They just want to fine-tune the price!

This is a neighborhood with zero lot lines, which you can see in this photo (in yellow). Each home has the exclusive use of one side yard, instead of splitting both sides. You can touch your neighbor’s house, but it does give you more usable space.

I don’t think there will be a noticeable discount needed for the flipper to resell a zero-lot-line house. There are several neighborhoods in Carlsbad, Encinitas, and Carmel Valley that have the zero lot lines, so it’s not that rare.

Price Discovery: What price reflects the risk? It was $675,000 last week:

Here is Tom giving a tour of the detailed work he did at the Stewart house:

Part 1 shows the work progressing over time with before-and-after photos too:

There hasn’t been much concern around San Diego about the ibuyers because they have been cutting their teeth in the lower-priced and more homogenized housing markets, where valuations are easier.

Hat tip to the reader who sent this in though – Offerpad did purchase a Talmadge home in December. They took title as Offerpad, and they used their regular Gilbert, AZ address too:

Link to Zillow listingThey paid $564,000, and tried all year to do better:

But the market didn’t come their way, and they ended up selling for less:

Even if they get a discounted commission (two different agents were involved, and the buyer’s agent got 2.5%), losing money on flips has to get old quickly!

A softer market should cause more of these guys to ‘self-sideline’.

Our YoY home sales are in decline, and it makes you think, ‘Here we go again”.

We know that sales are the precursor, and historically prices are the last to go. But with so many different variables this time around, could it actually be different this time?

Let’s consider the changes:

During the last two local declines (1992-1996 and 2007-2009), banks were the main culprits. They were visibly foreclosing and dumping homes, which affected the whole marketplace. Regular home sellers were burdened with the lower comps, and had to give them away if they wanted to move.

But now they’ve changed the accounting rules for banks, and they don’t have to dump everything they own. In fact, they can do whatever they want now.

Remember this McMansion in Carlsbad?

BofA first began the foreclosure process in 2011, but didn’t get around to actually foreclosing until July, 2017 – six years later! Then they off-loaded it to an investor in March, without having to put it on the open market. Bernanke told bankers in 2011 not doing anything that would harm the economy, and they took him up on it!

BofA first began the foreclosure process in 2011, but didn’t get around to actually foreclosing until July, 2017 – six years later! Then they off-loaded it to an investor in March, without having to put it on the open market. Bernanke told bankers in 2011 not doing anything that would harm the economy, and they took him up on it!

I think it’s safe to say that no matter how bad any future recessions might get, we don’t have to worry about a flood of foreclosures ever again.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Ok, so if the banks don’t/won’t foreclose and dump, then what about the institutional investors? They are smarter and more nimble – certainly they will be selling once they sense the top!

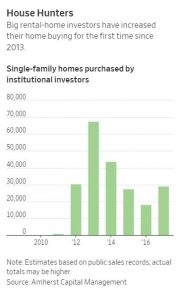

Not so fast – according to the WSJ, investor buying is on the upswing:

An excerpt:

Wall Street is betting that more well-off Americans will want to be renters.

Wall Street is betting that more well-off Americans will want to be renters.

Financiers who loaded up on homes after the housing bust for pennies on the dollar are buying yet more—despite home prices in many markets being at all-time highs.

Their wager: High prices, higher mortgage rates and skimpy inventory are making homeownership harder. Well-to-do families who might have bought a single-family home in another era are willing to rent a house now, especially if it means access to a good school system.

The number of homes purchased by major investors in 2017 was at least 29,000, up 60% from the previous year, estimates Amherst Capital Management LLC, a real-estate investment firm that made nearly 5,000 of those purchases.

This year, investors have raised billions of dollars from bond buyers, pension funds and even wealthy Chinese individuals to purchase more homes. They have been particularly aggressive buyers in places like Atlanta, Phoenix, and other metro areas with good schools and faster-growing economies.

Cash to acquire and renovate homes has become so abundant lately that some rental investors can’t spend it fast enough. Without enough homes to buy, some investors are now building their own in popular residential markets like Miami and Nashville, Tenn.—upending a traditional pattern of Americans buying starter homes and moving up.

“The American dream no longer includes homeownership,” said Jordan Kavana, chief executive of Transcendent Investment Management LLC, a south Florida firm that has been a big acquirer of rental homes. “You will earn your equity in other ways, not your home.”

Link to Full ArticleThe big-time Wall Street investors are betting on the affluent taking over the real estate market, and turning the country into a renter’s society. It may only affect 10% to 20% of the market for now, but that might be enough to keep it all propped up.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Local flippers and ibuyers are providing another floor. Any homeowner that will sell for 10% under value today will have a host of choices to pick from. If you play it right, and have a great realtor help you, it could turn it into a retail sale quite easily!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The biggest threat? While there are still people underwater, today’s market has to be the most equity-rich in history. If sellers had to dump in order to sell, they could – and still make a profit.

But for there to be an extended trend of declining prices, there would need to be a series of sellers in the same neighborhood that were all in the same boat. For now, we only see an occasional dump, and it doesn’t need to be more than 10% off to attract a crowd.

With the vast majority of recent buyers having to qualify for their mortgage, and use a regular down payment in order to buy their house, you have to like the prospects of them fighting to hold on to it, no matter what. Back in the last bust, too many people got in with little or no down payment, and got stuck with exotic financing that exploded on them. Those days are gone.

We’re most likely going to live in Stagnant City, with fewer sales in most areas. But it’s not the end of the world.

Get Good Help!

A feel for what Tom’s world is like: