by Jim the Realtor | Oct 22, 2018 | CA Homeowners Bill of Rights, Jim's Take on the Market, Market Conditions |

Did you know that our Homeowners’ Bill of Rights expired? Don’t worry – the state legislature has a new bill in place to reinstate many of the old provisions:

Article on the CA HBOR

I found the end of the article somewhat intriguing. The author explains that because of rising mortgage rates, sales will slow and prices flatten or drop:

The original Homeowner Bill of Rights was scheduled to expire in 2018, undoubtedly because the 2012 legislature figured the foreclosure crisis would be well over by now.

They were right — foreclosures reached a healthy level in 2016, and have remained low well into 2018. But the cycle of housing boom and bust continues to roll on, and the next recession is approaching on the horizon.

Experts forecast the next economic recession to arrive in 2020. Leading up to that recession, home sales volume will slow (as it is already in the process of doing) and home prices will flatten and drop off, expected to begin in 2019. This is all precipitated by rising interest rates, which have dampened buyer purchasing power and discouraged homebuyers.

Slowing sales and falling prices inevitably lead to an uptick in foreclosures as fewer homeowners who need to sell are able to. However, the 2020 recession won’t see the same type of foreclosure activity that reached a crisis level in 2008 and the years following. The laws put in place in the recovery years have stemmed the tide of unqualified homeowners, thus more homeowners will be able to continue to pay their mortgage during the coming recession than in 2008.

She notes that because home purchasers had to qualify, there will be fewer foreclosures the next time around – good!

For home prices to drop, we would need motivated sellers who will agree to sell for whatever the market will bear – like the bank clerks used to do with REOs. But with fewer (if any) foreclosures, who is going to dump on price?

Expect that any dip in pricing will be gradual and drawn out. Homeowners aren’t going to give up their equity easily, and would rather spend a few more years in paradise than believe the dreamy value of their home is wrong.

by Jim the Realtor | Aug 11, 2017 | CA Homeowners Bill of Rights, Foreclosures, Jim's Take on the Market |

Kamala Harris, who has been dubbed the ‘female Obama’, is likely to run for president of the United States – possibly as soon as 2020. This is a long article on her performance in public office:

LINK

This excerpt summarizes the impact from her $20 billion foreclosure settlement – another example of how the bankers got a slap on the wrist:

The deal Harris got for California was ultimately much better. It provided $18.4 billion in debt relief and $2 billion in other financial assistance, as well as incentives for relief to center on the hardest hit counties. This is particularly impressive when one considers the banks had originally only offered California, the state hardest hit by the housing crisis and fraud, $2-4 billion.

Nonetheless, the settlement was woefully inadequate. For one, while the $20 billion total sounds good, it was a fraction of what the banks would have had to pay to compensate for all of their malfeasance. For instance, investors had won $8.5 billion in a settlement with Bank of America over mortgage securities backed by faulty loans.

Secondly, the banks themselves paid very little — only around $5 billion, with most of the settlement involving the banks modifying loans owned by others, such as pension funds, who had nothing to do with the misconduct that necessitated the deal. In terms of direct financial relief, underwater homeowners — weighed down by average debt of close to $65,000 each — received around $1,500 to $2,000 each. One called it “a slap in the face for a lot of us.”

Moreover, more than half of the $9.2 billion in principal loan forgiveness in the state went to second mortgages, and many of those were already delinquent. While it did benefit homeowners, it also meant, as one economist told the LA Times, that in practice the banks “were writing off loans that were essentially dead.” A year later, only one-fifth of the aid went to first-mortgage principal forgiveness. And even at the end of this, just 84,102 California families had any mortgage debt forgiven — far short of the 250,000 originally predicted.

(more…)

by Jim the Realtor | Aug 6, 2017 | Boomer Liquidations, Boomers, CA Homeowners Bill of Rights, Foreclosure Count, Jim's Take on the Market, No-Foreclosure as Banking Policy |

The real estate market in our neighboring Orange County has performed much like San Diego’s. Here, Jon outlines the 12 differences between the bubble days of 2007, and now:

http://www.ocregister.com/2017/08/06/orange-countys-housing-bubble-10-years-later/

These stats show how the game has changed forever – there is no down side if banks are so reluctant to foreclose:

10. Distressed property: Too much debt and too many layoffs pushed many homeowners to the financial brink. Owners rushed to sell as bankers hit the market with their repossessed properties. In June 2007, 13 percent of homes sales were either short sales — banks agreeing to take less than owed — or sales of foreclosed properties. That distressed share of selling would become roughly half of the market during the next five years. But by June 2017, that share settled back to just 7 percent. Fortunately, it’s only a history lesson today. The supply of foreclosures to buy has shrunk from 463 in late June a decade ago to only 27 as this year’s summer began.

11: Warning signs: Nothing screams “danger” more than owners skipping house payments. Ponder what lenders were doing in June 2007 vs. this past June. Default notices, a first step in foreclosure: 1,144 then, 310 today. Auction notices, the official threat to sell: 598 then, 213 today. Actual foreclosures: 281 then (and 1,084 in June 2008) vs. 21 today.

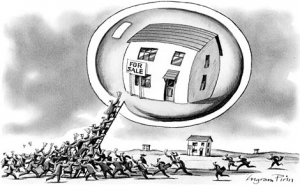

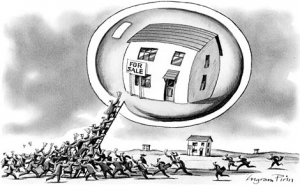

For the bubble to ‘pop’, and prices decline, we would need more than a trickle of distressed sellers who need to sell at whatever price the market would bear. A rash of boomer liquidations might happen, but with reverse mortgages being available, they have other options too.

All ahead full!

by Jim the Realtor | Mar 27, 2017 | Boomer Liquidations, Boomers, CA Homeowners Bill of Rights, Foreclosures/REOs, Jim's Take on the Market, Loan Mods, Market Conditions, Mortgage News |

Our local home prices have risen so quickly that it feels like we’re in ‘bubble’ conditions again – could the bubble burst this time?

The last two times the real estate bubble has popped, it was due to banks having to offload their foreclosed properties for whatever the market will bear. They flooded the market, and buyers – and prices – backed off.

But that has all changed now.

Look at the new devices being used to avoid a flood of desperate selling:

- New accounting rules.

- California Homeowners Bill of Rights

- Reverse mortgages

The accounting rules were altered so banks could hold their REO properties longer, and the California Homeowners Bill of Rights has, in effect, stopped foreclosing. Lenders are now required to offer a loan modification to anyone in default, and only if the homeowner can’t or won’t qualify are they at risk of being foreclosed. With today’s higher rents, there isn’t much relief for those in default to give back their house and go lease one nearby. Besides, with our higher home values today, they can always sell before getting foreclosed.

Homeowners who need money can get a reverse mortgage too, as long as they haven’t been tapping into their equity already.

We end up with virtually no desperate sellers who need to dump on price. Someone who wants to cash out quickly can price their home at last year’s comps and look like a deal!

The game is rigged – the Banking Cartel won’t let the bubble pop again!

For the bubble to pop, we would need a dramatic shift in the supply and demand – either a flood of homes hit the market, and/or we run out of buyers.

I thought we’d be seeing more baby boomers unloading their homes due to downsizing or sickness, and while the market consists mainly of those listings, there aren’t enough of them to call it a flood – at least not yet. Because they are in quality locations, more kids are probably trying to buy out their siblings and take over their parents’ house, rather than sell it. They could be moving in with the folks too, rather than sending them to assisted living.

Could we run out of buyers? You would think there would be a price point where buyers can’t or won’t go any higher, but there seems to be a steady flow of people with more horsepower. We saw two weeks ago the prediction that the population of San Diego County is expected to grow by 700,000 people by 2050, which is over 21,000 per year – where are they going to live? Will they be rich? They will need to be!

There hasn’t been enough (has there been any?) sellers so desperate that they had to dump on price – instead, they just keep waiting. We would need more than a few price-dumpers to start a panic, which could cause the market to flood with supply and burst the bubble.

Some air might escape occasionally, but it is doubtful that a market change could occur without the government finding a way to save the bankers.

People like this guy think the conditions are ripe for a downturn. But if prices started falling, sellers are more likely to wait, than dump, which would cause our market to stagnate, rather than crash.

by Jim the Realtor | Sep 6, 2016 | CA Homeowners Bill of Rights, Jim's Take on the Market, Short Sales, Short Selling |

With the difficulty the state politicians had in reaching an agreement – and it’s not done yet, Moonbeam still has to sign it – this will probably be the last chance for over-encumbered homeowners to short-sell and avoid taxation on their debt relief.

With less than four months left in 2016, maybe we will see a surge?

A bill giving state tax relief to California homeowners who received modifications of their underwater mortgages, or engaged in short sales, was revived and enacted in the final moments of the state legislative session Wednesday night.

After passing the Senate, the measure, Senate Bill 907, had been held in the Assembly Appropriations Committee earlier in the month, a non-action that is considered tantamount to death.

However, the bill suddenly popped up and was passed on the Assembly floor very late Wednesday, then sent to Gov. Jerry Brown by the Senate just moments before the midnight deadline for the 2015-16 legislative session to end.

While the federal government has exempted paper income from mortgage modifications and short sales – which mushroomed during and after the Great Recession – from income taxes, the state has only sporadically followed suit.

The Legislature approved a series of state tax exemptions for mortgage deals prior to 2014, but Brown vetoed a measure that would have extended tax relief to 2014 and 2015 income, citing the loss of state revenue.

If signed by Brown – not a certainty – SB 907 will allow tax exemptions for 2014, 2015 and 2016 and affected taxpayers can file modified returns for the first two years. The state would lose an estimated $152 million in income tax revenue.

Read more here: http://www.sacbee.com/news/politics-government/capitol-alert/article99278302.html#storylink=cpy

This was the best short-sale value I saw over the weekend – LINK

Save

by Jim the Realtor | May 16, 2016 | Bailout, CA Homeowners Bill of Rights, Jim's Take on the Market, No-Foreclosure as Banking Policy |

Collateral damage from the on-going No Foreclosure era – hat tip to Richard!

http://www.nytimes.com/2016/05/15/us/las-vegas-squatters-housing-collapse.html

LAS VEGAS — On a drive through this desert city, the blight from the housing collapse of eight years ago can be seen on almost every block: Overgrown yards and boarded-up windows identify the foreclosed and abandoned homes that still pockmark southern Nevada.

But not all of the dwellings are empty.

Squatters have descended on every corner of the Las Vegas Valley, taking over empty houses in struggling working-class neighborhoods, in upscale planned communities like Summerlin, and everywhere in between. And they often bring a trail of crime with them.

While some unauthorized tenants are families seeking shelter, police officers here say they are more frequently finding chop shops, drug dealers and counterfeiters operating out of foreclosed homes. One man who the police say was squatting has been charged with murdering a neighbor during a burglary.

But with a transient population of down-and-out gamblers and a glut of homes that have already been foreclosed, opportunists can still take their pick of thousands of empty houses. Inside one, squatters had scrawled a warning to stay away on a wall: “Violent tweekers on guard.”

In North Las Vegas, Deborah Lewis has seen just about every kind of squatter at the house next door since the owners walked away four years ago.

First, two women said they had just bought the middle-class home, but they stole water from the neighbors’ outdoor spigots at night, because like most abandoned homes this one had no running water. Then came a group of counterfeiters, who left their printing materials visible from the window, Ms. Lewis said. Later groups tore out the stove, refrigerator and copper wire; broke windows; and burned the kitchen floor. Since water at the house had been shut off, they left feces all over one room, a common problem that creates health hazards. (For electricity, those who can afford it can set up accounts with the power company; those who cannot often run wires to nearby utility boxes.)

“It’s been a total circus — you name it, we’ve had it next door,” Ms. Lewis, 58, said. “It’s scary, because you don’t know if these people are packing. One guy came over here, and he was looking in our window. Scary.”

But squatters are getting creative as well. Some repair broken windows and other damage from past squatters, pretending they own the place, neighbors say. At least one group of alleged squatters filed a federal lawsuit in an attempt to keep possession of the $800,000 home in the hills they were occupying, with its pool and views overlooking the Strip. (Repeated calls and knocks on the door at that house went unanswered, even though four people were visible in the living room. The police raided the house and arrested four people on Wednesday.)

In North Las Vegas, Officer Scott Vaughn has investigated 80 squatting cases so far this year, and said he had seen everything: prostitution rings; teenagers using vacant homes for parties; and even a squatter who tried to pull a Jedi mind trick.

“He was staring at me and telling me, ‘You don’t want to arrest me. You want to let me go,’” Officer Vaughn said. “I said, ‘The Force is not on your side today. You’re going to jail.’”

by Jim the Realtor | Feb 15, 2014 | CA Homeowners Bill of Rights, Foreclosures/REOs, No-Foreclosure as Banking Policy |

The hedgies got fired up this week over RealtyTrac’s report of California foreclosures rising 57% last month – the post is featured at the top of their front page, and has great comments: www.zerohedge.com.

At first glance, it would support my theory that banks deliberately turned off the foreclosure machine, and have merely started it up again:

Foreclosureradar.com’s California graph shows the same Y-O-Y increase:

But the CA Homeowners’ Bill of Rights had just been implemented in January, 2013, causing a drop in notices issued while servicers made adjustments. Last month’s number of California foreclosure notices is similar to every month since January 2013.

For locals, here are the San Diego County notices:

It’s likely that the banks/servicers have thrown every defaulter into some sort of loan modification – or if they didn’t fit, just let them lie. With a casual handling of defaulters, expect that borrowers will drift in and out of the foreclosure process as they enjoy a pay-if-you-feel-like-it policy.

Expect the foreclosure-notice data to be jumbled from now on, and not indictative of much really. What counts is the number of people actually getting foreclosed – here are the San Diego results of trustee sales for the last three years:

The number of properties actually foreclosed has dropped off the table in the last 12 months – in 4Q13 we averaged 150 foreclosed homes per month in a county of 3 million people. We will survive that – heck, in the previous fourth quarter (4Q12) we had triple the number of foreclosed properties, and the market took off in a frenzy!

by Jim the Realtor | Dec 3, 2013 | CA Homeowners Bill of Rights, No-Foreclosure as Banking Policy |

Reader avgjoe took exception to the whole idea of foreclosures in this environment. Yesterday he said,

“There are still people around me getn a free ride after 5 years. The banks have limited inventory by not foreclosing on people hoping for a bigger payday. Lets get the truth to the readers.”

Everyone pointed to the CA Homeowners Bill of Rights as the cause for the drop in foreclosures. The new law made the foreclosure process more stringent on lenders, and it contained the provision of granting attorney fees to any homeowner who felt the need to sue, whether they won or not:

https://www.bubbleinfo.com/2013/04/16/blaming-the-ca-hbr/

Whether it was actually the CA HBOR that caused the foreclosure process to screach to a halt, or just a handy excuse, we will probably never know. But lenders must be doing everything they can to keep people in their houses – the unemployment rate hasn’t changed much, and incomes aren’t rising.

How else can you explain why foreclosures have dropped off the table?

Third-Quarter Counts:

| 3Q-Year |

Trustee-Sales Completed |

Short-Sales Completed |

Total |

| 2009 |

3,776 |

1,186 |

4,962 |

| 2010 |

3,460 |

1,651 |

5,111 |

| 2011 |

2,525 |

1,735 |

4,260 |

| 2012 |

1,599 |

2,260 |

3,859 |

| 2013 |

493 |

892 |

1,385 |

The drop in short-sales looks like the smoking gun.

According to Zillow, 21% of San Diego homeowners who have a mortgage are underwater, and are over-encumbered by an average of 36.8%, or $124,526:

http://www.zillow.com/blog/research/2013/08/28/negative-equity-rate-falls-for-5th-straight-quarter-in-q2/

The 21% equals 97,422 homeowners in San Diego County who are underwater, and only 892 of them, or 0.1%, completed a short sale in 3Q13 with the end of debt-tax forgiveness barreling down on us??

I’m with avgjoe in thinking that the lenders have conveniently adapted a policy of non-foreclosure, and are hiding behind the CA HBOR. They are putting no pressure on deadbeats to pay, otherwise the short-sale counts would be much higher. Those who are the furthest underwater have the least reason to pay, and banks have the most to lose – no surprise that the banks want to limit their losses.

The CA HBOR was announced in summer of 2012, and has been a law for almost a year. The banks have had plenty time to adapt to the new law, and yet the foreclosure notices keep dropping – did most defaulters just go back to making their payments?

The banks own this country, and manipulating the system has become acceptable. Isn’t it a possibility that the market rebound has been so good that banks just decided to not adding more distressed inventory, and keep the good times rolling – at least for now?

by Jim the Realtor | May 8, 2013 | CA Homeowners Bill of Rights |

A California man successfully halted a foreclosure sale on his property using the newly minted California Homeowner Bill of Rights to obtain a court injunction against two foreclosing parties: Bank of America and its Recontrust Co. subsidiary.

A California man successfully halted a foreclosure sale on his property using the newly minted California Homeowner Bill of Rights to obtain a court injunction against two foreclosing parties: Bank of America and its Recontrust Co. subsidiary.

For simply obtaining the HBOR injunction, the homeowner’s attorney is requesting $20,255 in legal fees and costs – a compensation request that is permissible under HBOR since the legislation allots borrowers reasonable attorneys fees and expenses for successfully obtaining an injunction.

Attorney Robert Jackson with Jackson and Associates out of California says the injunction alone may cost BofA/Recontrust upwards of $60,000 when calculating in attorneys fees and expenses from both sides.

“The biggest problem with the HBOR from the investor standpoint is the litigation risk of having to pay legal fees,” Jackson said. “The way the thing breaks down is when you get an injunction, the prevailing borrower gets all of their legal fees paid by the servicer and the investor.”

This is one of the first legal disputes to show the real strength of HBOR and it’s effectiveness in stalling proceedings and increasing expenses for servicers that are accused of violating one of the provisions of HBOR.

Read more here:

http://www.housingwire.com/news/2013/05/08/california-bill-rights-allows-homeowner-halt-bofa-foreclosure

by Jim the Realtor | May 7, 2013 | CA Homeowners Bill of Rights |

Can you help but be suspicious about what is really going on when you see lousy reports like this? Reporters aren’t looking too hard at it. From HW:

The California Homeowner Bill of Rights is slowing the movement of distressed properties in the West Coast state, Lender Processing Services said in a report.

HBOR is one of the more aggressive state-based pieces of legislation drafted in response to the national foreclosure crisis and the dramatic uptick in foreclosures that swept through California after the real estate market bust.

HBOR created a private right of action and numerous foreclosure rules for mortgage servicers foreclosing in the state.

Analysts early on said the bill would slow foreclosures in the state, but LPS data shows results vary at different stages of the default process.

For example, foreclosure auction sales slowed dramatically in California even as ‘foreclosure starts’ — the beginning part of the foreclosure process — continued uninterrupted.

Foreclosure sales in California fell 35% in Q1 from the fourth quarter while increasing 13% nationally.

FR reporting 50% decline between 1Q13 and 4Q12:

“On the foreclosure starts side of things, HBoR does not seem to be having much measurable impact – they’re down just 1% over the same period,” a spokesperson for LPS said.

FR says NODs are down -44%, and NOTs down -40% over same period:

This trend is not unusual, said Herb Blecher, senior vice president of LPS Applied Analytics. In fact, he said the firm expected foreclosure sales to decline when HBOR took effect.

“We were actually looking at that stage of the process,” he explained. “We noticed a very similar drop in Nevada after the implemantion of their legislation led us to believe we needed to keep an eye on this.”

As to why foreclosure starts continue while sales decline, Blecher says a ‘start’ is only the beginning of the default process. It’s not until the foreclosing party is ready to take the property that regulations trip up servicing firms.

“These (regulations) typically impact the end of the process because the servicers can continue to work with the borrowers to pursue collection and loss mitigation options after a foreclosure referral,” Blecher said. “The foreclosure sale is when the bank takes title.”

At this point, the borrower’s redemption period is over and Blecher says servicers begin to see the impact of state regulations as they try to foreclose on the property while complying with all of the new checkpoints and rules.

JtR: Here are the key provisions – where is the compliance problem when you have already been working on the loan-mod file for months?

http://oag.ca.gov/hbor