New Design Trends

Last week was the International Builder Show | Kitchen & Bath Industry Show 2024 in Las Vegas.

John Burns was there and in his newsletter today he featured the following gizmos:

Last week was the International Builder Show | Kitchen & Bath Industry Show 2024 in Las Vegas.

John Burns was there and in his newsletter today he featured the following gizmos:

Golf-course redevelopment is a terrific solution to providing new housing in the middle of town. They will work out the kinks like building enough roads.

A judge’s ruling halted construction this week of the 536-unit Junipers development in Rancho Peñasquitos — and could complicate and delay approvals of other dense housing projects across San Diego.

Superior Court Judge Ronald Frazier nullified an analysis of how the Junipers would affect nearby traffic, noise and wildfire threats, saying it had failed to account for two large nearby housing projects. In a ruling that made final a tentative ruling he issued last week, Frazier halted construction of the Junipers, where 36 units are complete, and said it can’t resume until the analysis is redone to account for the long-term presence of the 331-unit Millennium PQ and 826-unit Trails at Carmel Mountain Ranch.

The resident group that had sued to stop the Junipers called the ruling a victory for San Diego’s neighborhoods because it will require developers to provide more robust mitigation when they build impactful, dense projects.

In particular, the residents want Junipers developer Lennar Homes to pay for building more evacuation routes for their wildfire-prone area.

“Our goal in bringing this lawsuit forward is to require the city of San Diego to perform environmental review to address wildfire impacts on redevelopment in our area,” the PQ-NE Action Group said in a statement. “We are very pleased with the final ruling.”

The city and Lennar, which declined to comment Tuesday, could appeal to a higher court.

Or Lennar could settle with the residents, for instance by agreeing to construct additional evacuation routes.

If the ruling isn’t overturned on appeal, attorneys for Lennar and the city say it could have far-reaching impacts on how government agencies must analyze the effects dense housing projects might have on traffic, noise and wildfire threats.

“It would potentially grind development to a halt,” Deputy City Attorney Ben Syz told Judge Frazier in court last Thursday. “The city needs certainty as to what it’s looking at and what it’s analyzing.”

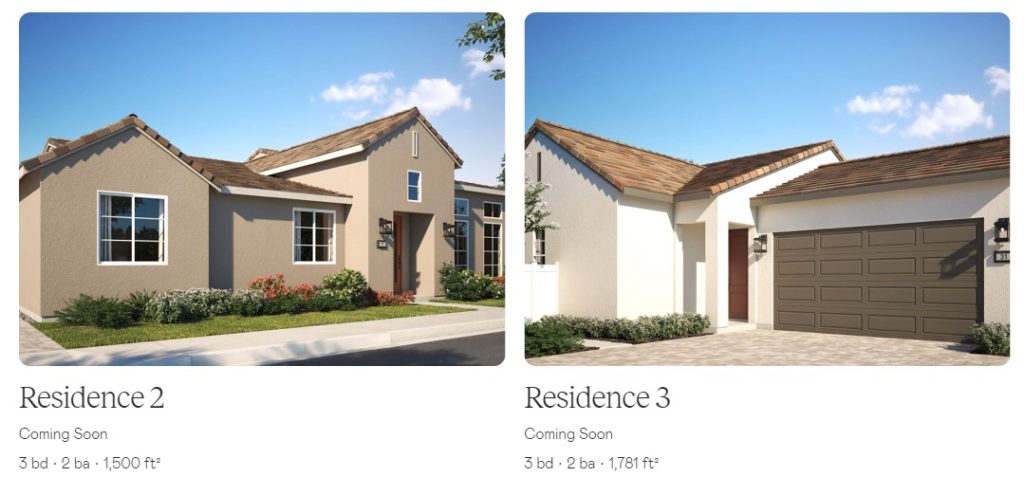

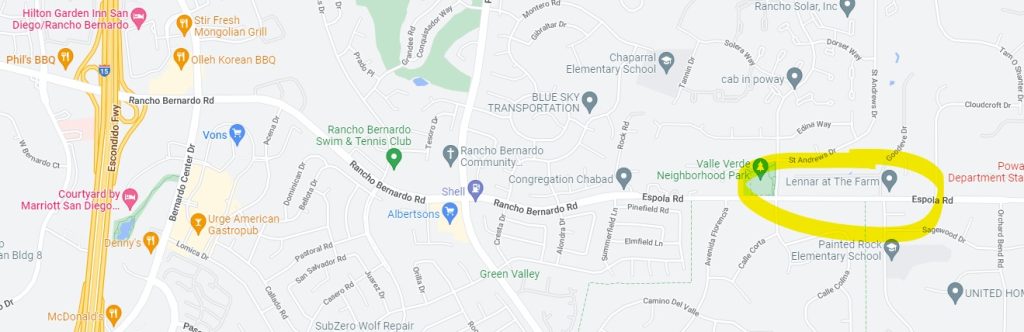

Ok, ok you want to downsize but you don’t want to bake in the desert – plus you like living in San Diego. Aren’t there any newer, smaller choices around here?

Lennar has purchased three local golf courses and are on their way to building them out. The development of the Carmel Mountain Ranch golf course off the I-15 freeway (above) faced some resistance from the locals, but they beat that back and a gated senior community is now underway.

The Junipers is a senior community (55+) in Rancho Penasquitos and will include a mix of 455 single-family detached-homes and townhouses for sale. There will also be 81 attached homes for rent for low-income seniors households. It will include a 2.87-acre public park and a 2.82-acre loop trail.

Pricing isn’t out in the open but I’m guessing it starts just under a million.

https://www.lennar.com/new-homes/california/san-diego/san-diego/junipers

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Another new-home development is called the Farm, and it’s right off Rancho Bernardo Road. It isn’t solely for seniors, but they have a couple of one-story plans. Here’s a quick tour of their 2,500sf one-story home under construction:

For new homes, it’s mostly just infill projects now in the prime areas so even the big boys are looking for smaller projects. It looks like Toll picked this up for $12 million last October, and they are going to build 4,765sf to 6,036sf houses that are the same or similar to what they built at Palomar in PHR.

Yesterday, they sent emails saying prices will start at $3,500,000 for the 25 houses, which means they should get into the $4-millions pretty quick. Here’s what their biggest model in PHR looked like just four years ago, which coincidentally is up for resale, priced at $5,995,000:

https://www.tollbrothers.com/luxury-homes-for-sale/California/Del-Mar-Mesa-Estates

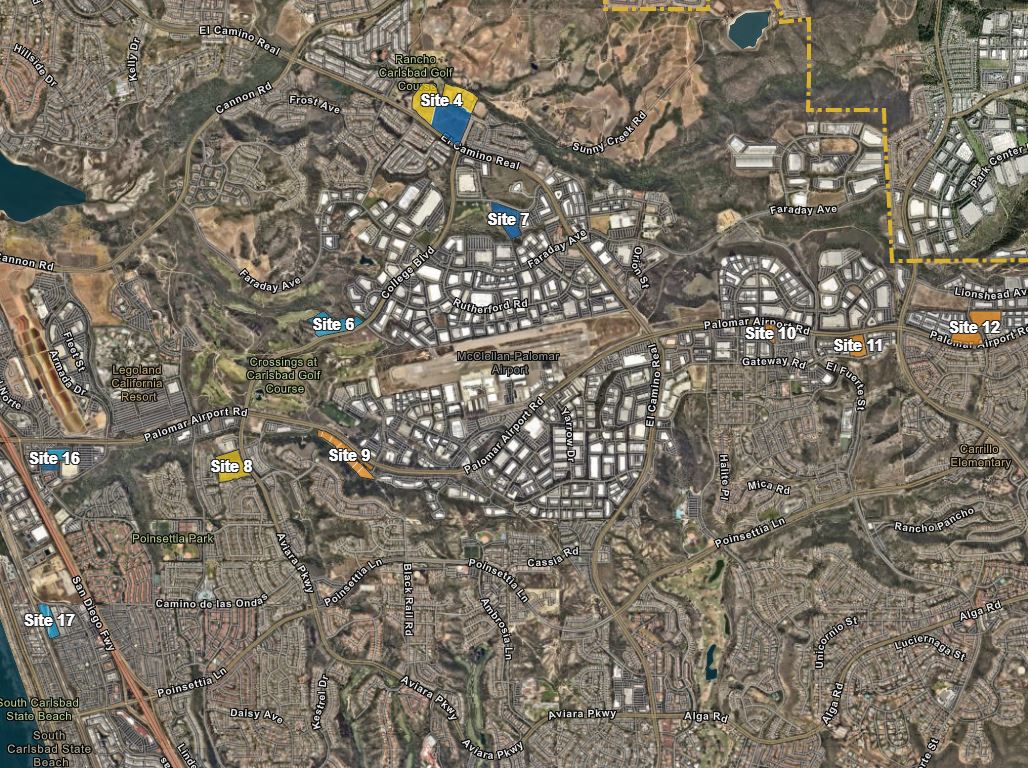

For those who want to purchase a brand-new home in Carlsbad, the Sunny Creek area is the last remaining spot where 100+ homes will be built eventually.

The ‘subject property’ above has listed for $7,500,000 for 19 approved lots:

https://www.loopnet.com/Listing/Sunny-Creek-Rd-Carlsbad-CA/24450629/

But the Big Kahuna is the 104-lot Cantarini Ranch property, which has been in process since 1996. The detailed history of its development can be found here:

https://cantarini-hollysprings.com/history

It is owned by the Wests, who are the billionaires who also own the West Bistro, and West Steakhouse on Cannon – both of which are rumored to remain closed after the pandemic. The Cantarini Ranch story is a fascinating tale on the trouble people have getting homes built.

There have been several sound bites lately about the prognosticator who called the last bubble – and at first glance, the headlines want you to think that she is calling the top again. But she’s not – all she said was that housing production is going full steam – an excerpt:

“The perception that housing is drastically undersupplied and that a strong demographic picture lies ahead is creating a false sense of security,’’ according to a report by Zelman’s firm entitled “Cradle to Grave.’’ “By our math, both single-family and multi-family production are already ahead of normalized demand and estimates of a housing deficit are grossly exaggerated.’’

The city is seeking input on where new housing units could be built in Carlsbad to satisfy a state requirement that cities accommodate their fair share of the region’s housing needs, including homes for people of all income levels and stages of life.

Eighteen proposed locations were chosen based on public input gathered last year, input from a citizens advisory committee and direction from the City Council.

Over the next eight years, Carlsbad was assigned 3,900 new housing units.

The city can meet some of this number through existing locations and approved projects, but the city still needs to identify locations for about 2,600 new homes. Most of those need to be affordable for people with moderate to low incomes, according to state formulas for household income levels.

Review sites on an online map.

The city is seeking input on proposed sites that would need to be rezoned, either to allow housing where it’s not allowed today or increase the number of units allowed on sites already zoned for housing. Owners and people living within 600 feet of all the potentially affected properties have been notified by mail of the potential rezoning.

The city would not build housing on these sites. Instead, the city’s obligation is to identify space for housing and create policies that would facilitate new housing to be built based on different income levels and stages of life.

All feedback gathered will be presented to the City Council in early 2022.

https://www.carlsbadca.gov/Home/Components/News/News/588/15

Let’s also mention Carlsbad’s efforts to meet state requirements for low-income housing:

https://thecoastnews.com/carlsbad-city-council-approves-70-affordable-housing-units/

CARLSBAD — Affordable housing is a challenge for many cities as the housing crisis rages statewide.

But the Carlsbad City Council chipped away at its state-mandated affordable housing requirements by approving 70 units for very-low to low-income households during its Aug. 31 meeting.

Additionally, the council approved a $3.1 million loan as requested by Bridge Housing, which partnered with Summerhill Apartment Communities, to develop the Aviara Apartments.

The loan will allow Bridge Housing to cement its application for state and federal tax credits to help fund its affordable portion of the 329-unit project on Aviara Parkway just south of Palomar Airport Road, according to Mandy Mills, Carlsbad’s director of housing and homeless services.

The Aviara East Apartments, where the 70 units will reside east of Aviara Parkway and north of Laurel Tree Road, make up the bulk of the affordable units for the project

In total, 81 units, or 25% of the total project, will be affordable units, Mills added.

The cost for the entire project, which rests on lots east and west of Aviara Parkway, is estimated at $30.9 million, Mills said.

“The project started the process in 2017 (with design and environmental reviews) before the Planning Commission approved it in December 2020,” Mills said. “Bridge will submit tax credit and bond allocation requests next month … and construction is expected to start in summer 2022.”

Rent will run between $600 and $1,700 depending on area median income (AMI) of each resident. Mills said seven units each are allocated for 30% and 50% of AMI and 55 residences for 60%.

Summerhill will manage the market-rate units, while Bridge Housing will operate the affordable units, she explained.

Jeff Williams, of Bridge Housing, said his company has two other developments the company manages in Carlsbad.

Bridge Housing owns the 334-unit Villa Loma project and 92 units at Poinsettia Station Apartments.

Bridge Housing intends to secure tax-exempt bonds and tax credit equity to finance the majority of the project’s cost to improve its competitiveness for bond and tax credit financing, according to the staff report.

Per the estimates, state and federal tax credits would account for $15.3 million along with a permanent loan of $7 million for the bulk of the funding.

The $3.1 million, though, will come from the Housing Trust Fund, which has a current balance of $13.6 million.

“Our mission is to provide housing, services and opportunities for residents of all income levels,” Williams said. “We do that by building on our record.”

The average cost per unit, though, is about $442,000, while city staff cited a Terner Center Report of the cost-per-unit for affordable units in the state is at $480,000, an increase of nearly $70,000 since 2008.

Another benefit of the 81 units is pushing the city closer toward its required affordable housing allotment under the Regional Housing Needs Assessment.

The RHNA numbers set by the county is 3,873 units for Carlsbad and more than 2,000 must meet very low to low-income residences.

This RHNA cycle runs from 2021 through 2029.

https://thecoastnews.com/carlsbad-city-council-approves-70-affordable-housing-units/

The developer paid $4,900,000 cash for this site in 2020, so he must have had some assurance from the Encinitas City Council/Planning Commission that he could build his 72-unit apartment house here.

It appears that expanding La Costa Avenue to four lanes will be required – though there aren’t plans or money to do so – yet the Encinitas City Council approved the development:

https://thecoastnews.com/encinitas-council-approves-new-plans-for-vulcan-avenue-project/

An excerpt:

The site of the project is 1967 N. Vulcan Avenue in the northernmost part of Leucadia near La Costa Avenue. The intersection of Vulcan and La Costa is a major concern to residents who oppose the development.

Wermers said the updated project plans now include changes to Vulcan Avenue that are meant to make the area safer for pedestrians and bicyclists.

“When we do this it also promotes vehicle safety,” Wermers said.

Wermers also made a commitment to pay his company’s fair share in whatever changes the city decides to make at the Vulcan and La Costa intersection.

“Whatever you guys decide, we want to pay our fair share,” Wermers added.

There was more support for the newly redesigned project, some pointing to the need for low-income housing in the area and the project will boast 12 units designated as low-income.

“We need more roofs over our heads. This housing project is the perfect one to bookend Vulcan Avenue and Leucadia,” resident Kevin Daniels said. “I can’t express this enough, this project is a perfect fit.”

https://thecoastnews.com/encinitas-council-approves-new-plans-for-vulcan-avenue-project/