www.sacramentoappraisalblog.com

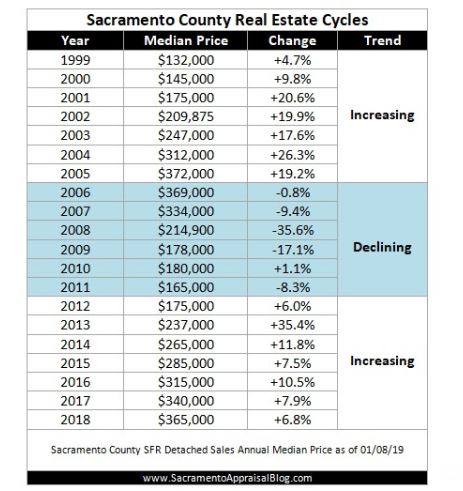

Ryan posted the history of real estate cycles in Sacramento County, so here are the same years for North San Diego County’s coastal region for comparison. Human nature tends to flow in the same direction everywhere, and as a result, our history looks a little like his:

| Year | |||

| 1999 | |||

| 2000 | |||

| 2001 | |||

| 2002 | |||

| 2003 | |||

| 2004 | |||

| 2005 | |||

| 2006 | |||

| 2007 | |||

| 2008 | |||

| 2009 | |||

| 2010 | |||

| 2011 | |||

| 2012 | |||

| 2013 | |||

| 2014 | |||

| 2015 | |||

| 2016 | |||

| 2017 | |||

| 2018 |

At the time it seemed like sky was caving in, but looking back we only had two bad years (2008 and 2009) in the last twenty. There was some scuffling around as we found our way in 2006-2007, and 2010-2012, but given that our market had been injected with the most exotic financing ever known to man, and then tanked by foreclosures and short sales, I think we did pretty good to survive it as well as we did.

Now what?

With 90% of the NSDCC active listings priced over $1M, all we need is wealthy people to keep coming here to buy their forever home. We’re still cheaper than the LA/OC and Bay Area, so we look attractive to downsizers.

Our pricing may bounce around, but without brainless bank clerks dumping properties for any price, who else is going to cause a collapse? We could run low on the number of buyers – and if we did, all it would do is cause a protracted descent; re: soft landing over years.

Boomer liquidations?

Here’s a conversation I had yesterday with a guy who is 80+ years old and who has lived in his house since the 1960s:

Him: Convince me why I should sell my house.

Me: How are you getting around?

Him: I ride my bike to the store.

Me: Do you need the money?

Him: No.

Me: Have you ever dreamed about buying a house on the lake and fishing the rest of your life?

Him: No.

Me: Are you married?

Him: No.

Me: Did you know that if you did sell, you’d have to pay six-figures in taxes? How would that make you feel?

Him: What? I only paid $19,500! I’d never pay that much in taxes!

Me: What happens upon your demise?

Him: My daughter will inherit – she grew up here, and will likely move back in. But I told her if she doesn’t move in, it’s ok with me to sell it.

Me: Do you have a family trust?

Him: Yes.

Me: Did you know that if she sells the house, she will pay no tax?

Him: You’re kidding? If I sell it, I have to pay the tax man six-figures, but if she sells it, she pays nothing? Jim, I think we have the answer!

There will be occasional sales where sellers hire bad agents and get taken advantage of, but there won’t be an avalanche of desperate sellers dumping for any price. It would take a tsunami, earthquake, or terrorist event at the border to cause a drastic shift in housing – which could happen!

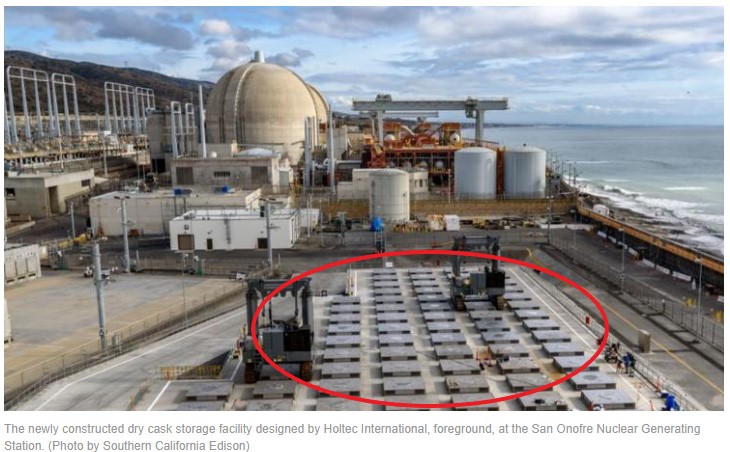

Here’s the latest photo of the nuclear waste being stored right on the surf at San Onofre. All we need is one crack in a storage cask…..

Without a catastrophic event, what’s the worst we can expect?

Maybe 5% drop in pricing in the short-term?

Any more than that, and sellers will just wait it out.

Going back to 1999 is not enough to paint the entire picture. As one who survived the S&L crisis, take these numbers back to 1989-90 and analyze from the prior peak.

Oh come on. We don’t even have S&Ls any more.

I’ll go one step further and assert that the 2008 crisis isn’t applicable to today, or the future.

(here he goes again…..it’s different this time)

Three reasons:

1. Every home buyer for the last nine years has had to qualify for a mortgage – and guidelines are strict.

2. Banks don’t foreclose any more. I just had one where the homeowner didn’t make payments, and didn’t answer the phone for a year. Yet no Notice of Default filed, or even a threat. Banks are supposed to reach out and at least offer a loan modification, but in this case none was requested or accepted, and the bank still didn’t file a Notice, let alone foreclose.

3. There are virtually no more adjustable-rate loans. No payment surprises.

The economy could tank – and isn’t it possible that we could have a deep recession? Yep, and banks would just let people live without making payments. They found out in this last crisis that payment suspension/forgiveness is a much better answer than a messy REO portfolio.

The rules have been changed. Trying to learn from history 20+ years ago will just give us the wrong impression.

If anyone is worried about current mortgage holders, here’s a report:

http://www.mortgagenewsdaily.com/01112019_qualified_mortgage_rule.asp

My only point was from 1990 to 1997-98 the So Cal real estate market was declining which was right before 1999 when this graph started. This would show a period of decline 1990-97, increase 1997-2005, decline 2006-2011 and lastly an increase 2012-?. Will this be a longer cycle of increase with no decrease? Only time will tell. This data APPEARS to be cyclical with an upward slope from a mathematical perspective. Buy and BE ABLE to hold CA real estate because declines do happen and hurt if you are forced to sell.

It was interesting that when we bought our house in 2017, our initial loan was with NBKC Bank, then it got sold to Wells Fargo Bank and then Wells Fargo sold it to Fannie Mae. As of right now, Wells Fargo is still our servicer of our loan and we make our payments to them, but our loan is held by Fannie Mae.

“The federal government now invests or insures over 90 percent of mortgages in the US via Fannie Mae, Freddie Mac and Ginnie Mae.”

https://www.cbo.gov/sites/default/files/111th-congress-2009-2010/reports/12-23-fanniefreddie.pdf

Something I keep hearing in my daily reading is “Don’t fight the fed.” It seems that their power to print unlimited amounts of digital currency means that they will and have done whatever it takes to prevent another tanking event. If it’s housing, they’ll buy all the mortgages (they already own over 90%), if stocks then they’ll just buy equities.

Yeah, the rules of the game have been changed and we need to go with this new flow or get left behind!

Exactly!