In spite of the hysterics presented by those with an agenda, it turns out the tax reform might not be as bad for housing as they thought – at least for those who make less than $20 million per year. From HW:

For the most part, the latest tax reform will boost the average paycheck and do little to harm the housing market.

However, according to two recent expert reports, the devil is in the details.

Thomas Torgerson, co-head of Sovereign Ratings at ratings agency DBRS, said that for most households, tax reform should only have a marginal effect.

“Even in the more expensive metropolitan areas, DBRS estimates that most households with taxable income of less than $400k will see either minimal change or an increase in disposable income,” he wrote in a report today.

“Households with taxable incomes above $400k are likely to experience a decrease in disposable income, though the effects may be muted for households that are already subject to the Alternative Minimum Tax,” he added.

However, things change slightly in areas with higher than average state and local taxes, as well as the more expensive metros in the nation right now. The law caps SALT tax deductions at $10,000, so it’s possible some homeowners may need to move to more affordable areas.

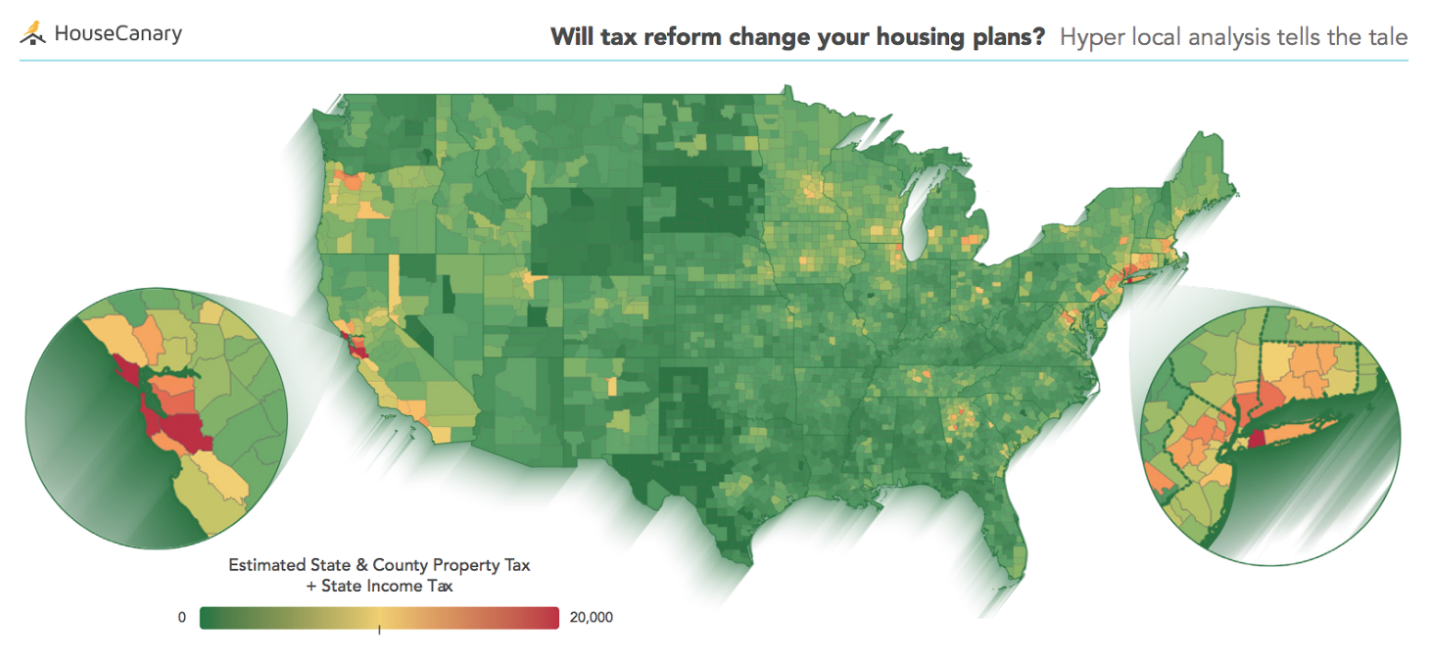

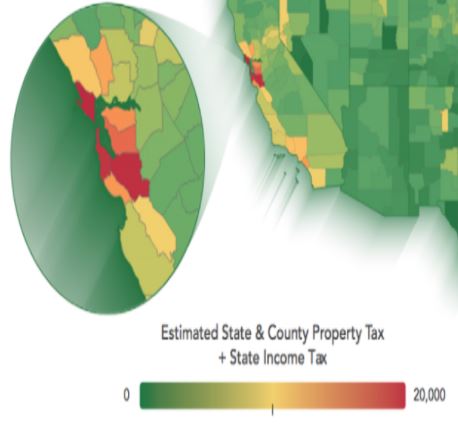

Real estate valuation and data analytics service HouseCanary will soon release the following report: “Will tax reform change your housing plans? Hyper local analysis tells the tale” And in that report, provided early for the benefit of HousingWire’s readers, analysts at HouseCanary dug through mortgages from 2017 between $750,000 to $1 million, to see how many current households would be impacted by the new tax law.

They found, overall, the average estimated household impact in the top 50 MSAs will be $1,950 per year, or $162.50 per month.

According to the Torgerson DBRS report, disposable income is most likely to decline in higher income households with incomes above $400k and particularly above taxable incomes of $1 million, where lower tax rates are more than offset by the expected increase in taxable income due to the loss of SALT deductions.

“In high SALT areas, DBRS estimates the reduction in disposable income is likely to average 3% for taxable incomes between $400k and $1 million, and could exceed 7% at incomes beyond $20 million. However, housing decisions within this income segment are less likely to be constrained by a reduction in disposable income.

Moreover, many of these households are presently subject to the Alternative Minimum Tax.

If the deductibility of SALT is already effectively limited due to AMT, the changes will have less of an adverse impact on disposable income for some of these higher income households. Furthermore, many of these same households should benefit financially from corporate tax changes, either as owners of a pass-through business or simply due to gains already reflected in their stock portfolios.”

Click for full article

The math is weak. A $500k home and a single $70k salary and you are over $10k in property + CA income levies. That’s a lot more families than the map implies.

It does more or less eliminate the tax advantages of home ownership, doesn’t it?

It does more or less eliminate the tax advantages of home ownership, doesn’t it?

Deducting the mortgage interest was always the biggest benefit, and it’s still in play.

If you bought a house today with a $750,000 mortgage at 4.125% for 30 years, the deductible interest in your first year is $30,694.98. I’d call that a tax advantage.

But let’s list all the crazy stuff in play when trying to figure the impact on housing:

1. The doubling of the standard deduction is what made the president of C.A.R. go nuts, and who is still standing by his claim that the tax reform is bad for housing in California. But how many people who are taking the standard deduction (and not interest deduction) are potential home buyers in CA? The C.A.R. is still saying that values will decline by 6.3%.

2. N.A.R. said that values will decline by 5% to 15%.

3. The AMT wasn’t changed, and still screws up any simple calculations of actual impact.

4. One-third of buyers pay cash, and get no interest deduction.

5. Rents are sky-high. Even if the tax benefits are somewhat nebulous, every tenant feels like they are throwing money away. If there were no tax benefits, wouldn’t it still be worth it for most to lock down their housing expense? Yes, but only for those who were planning a long-term hold. And here we are, 8+ years of that pattern of buyers holding long-term.

6. The equity built between appreciation and paying down the mortgage will far exceed the change in tax benefits derived from this tax reform.

7. Mark Zandi, the one expert putting a number on it, stated that values would decline 4%. Then he said the expected appreciation would be 4% less than it would have been.

I don’t know how accurate their $162 per month difference is, but of our potential buyers – those who make enough money to buy a house around here – is going to say, “Forget buying a house, and its other benefits, because that extra $162 per month from tax reform is killing me!”

It is why I bolded this remark in the article:

However, housing decisions within this income segment are less likely to be constrained by a reduction in disposable income.

From C.A.R. – LOVE THEIR LAST LINE:

Impacts to Home Sales and Prices w/$750K MID Cap

• Home prices would drop an average of 6.3 percent in the short term, with some price ranges dropping more than others.

o About 4.0 percent drop in home prices would be due to the loss in tax incentive as a result of higher standard deduction of lower MID cap.

o Another 2.3 percent decline in home prices would be due to the inability to deduct state and local property tax.

o Properties currently priced below $500k would experience a 10 percent drop, as many buyers who purchase at or below this price range are more likely to take advantage of the increase in the proposed standard deduction, and would nullified tax benefits of the MID deduction and the property taxes deduction.

o The decline in price is not as severe as that of the previously proposed tax reform plan, as the current proposed plan allows up to $10,000 state and local property taxes deduction instead of eliminating the deduction completely.

• The proposed tax reform would also lead to fewer sales transactions as the tax incentives of being a homeowner vanish for many who want to purchase a property.

o Existing home sales would decline by 4.4 percent if the proposed tax plan were to be implemented, as the cost of owning a home increased and fewer buyers purchased properties for tax saving purposes.

o Approximately 22,550 home sales would be lost in the year following the implementation of the proposed tax plan.

• The decline in home value would also lead to homeowners’ reluctance to put their property up on the market and further tighten up the housing supply condition in California.

o An estimated 1.5 percent of the inventory would be lost in the first year after the implementation of the proposed tax plan.

• The elimination of the MID deduction for second homes would lead to a decline in home prices of 3.3 percent in the second home market and a 2.3 percent in sales activity in the overall

second home market.

o The effect on the market as a whole (including primary home sales), however, would be minimal.

More on C.A.R. position:

I’ve had an email conversation with Steve White, the current president of the California Association of Realtors about his remarks, and the origin of the C.A.R. research above.

He has not provided any of the research used to generate the above opinions, and instead he pointed me to the final C.A.R. press release on tax reform, which he thought would clear everything up:

LOS ANGELES (Dec. 15) – The CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) issued the following statement in response to the final Tax Cuts and Jobs Act tax reform bill released today:

“The final tax reform bill released punishes homeowners and weakens homeownership, and in fact, it looks at homeowners and the housing market as nothing more than a piggy bank,” said C.A.R. President Steve White. “Congress is touting this as a tax cut for middle-class families, but the reality is that thousands of California middle-class homeowners will be the first ones to face tax increases.”

“California is a donor state, meaning for every dollar we send to the federal government, they send back less than a dollar. California homeowners and consumers deserve better. With homeownership already a stretch, or out of reach altogether for so many Californians, now is not the time to make owning a home more difficult.”

“C.A.R. will continue to advocate for homeownership and urge Congress to vote No on legislation that negatively impacts California homeowners and lowers corporate taxes on the backs of families wanting to buy a home,” said White.

Leading the way… ® in California real estate for more than 110 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States, with more than 190,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

“Leading the way… ® in California real estate for more than 110 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States, with more than 190,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.”

Yeh, and… how’s that been working for everyone so far?

“But how many people who are taking the standard deduction (and not interest deduction) are potential home buyers in CA?”

That’s every potential first time home buyer I know. I feel the bottom of the market will feel it the most. When I purchased my first home the Tax benefits were reason #1. Will this have a draw on the NSDCC area? I agree, probably less or minimal at those income / status levels.

That’s every potential first time home buyer I know.

Can you qualify that Ron? What part of town are you in?

Is it possible thatt people buy a home because they simply want to own and not rent, and eventually have no mortgage payment? That’s why, I guess foolishly, we bought our first home. Everything else was just picking the flea shit outta the pepper.

Seems like the fight to deduct SALT and other local taxes is not finished: http://nymag.com/daily/intelligencer/2018/01/workarounds-underway-to-blunt-gop-tax-bill-impact.html