There might be a little hiccup here on the reporting of the latest SD Case-Shiller Index – or it really flattened out in October. The index is being reported as the same for September and October:

Here’s what I used last month:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Here is how it reads today directly from the Standard and Poor’s website:

FRED usually reports their data a few hours later, so I’ll check to see if it changes. But for now, it looks like our local index hit the skids in 4Q17.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Update: Yep, FRED is reporting the exact same number as in September:

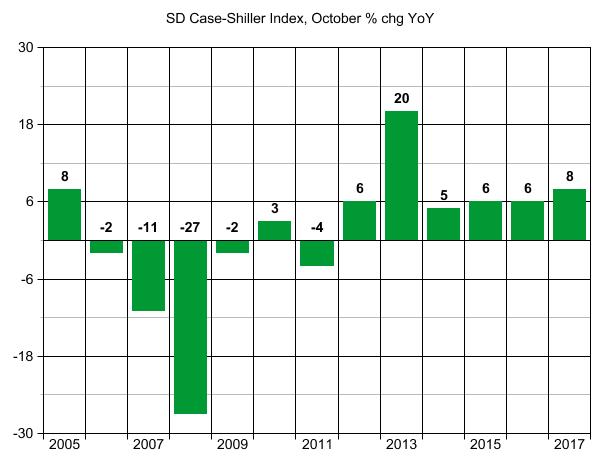

San Diego Non-Seasonally-Adjusted CSI changes:

| January ’17 | |||

| February | |||

| March | |||

| April | |||

| May | |||

| June | |||

| Jul | |||

| Aug | |||

| Sept | |||

| Oct |

The highest reading of the San Diego NSA CSI was 250.34 in November, 2005.

From cnbc.com

“Since home prices are rising faster than wages, salaries, and inflation, some areas could see potential home buyers compelled to look at renting,” said David M. Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices.

The strongest annual gains occurred in Seattle, where prices have shot up 12.7 percent since October 2015. Las Vegas has seen prices increase 10.2 percent, while San Diego notched growth of 8.1 percent. Of the 20 metro areas tracked by the index, Washington, DC reported the smallest price gain with 3.1 percent.

As the economy has steadily recovered from the 2008 financial crisis, demand from would-be buyers has steadily improved. The 17-year low unemployment rate of 4.1 percent has left more Americans confident enough to put bids on homes. Sales of existing homes in November reached their strongest pace since December 2006, according to the National Association of Realtors. But the sales growth hasn’t compelled more people to list their homes for sale, as the number of properties on the market has tumbled nearly 10 percent in the past 12 months.

FRED’s re-calibration on the September index – that is flat, and not +0.01%:

Similar experiences in other hot towns – the cooldown is only a couple of points the year after recent peaks:

But that’s changed more recently as the hottest cities have begun to cool down only gradually.

Portland topped the nation for home price increases for 10 months through mid-2016. During the streak, it averaged home price increases of 12 percent from a year prior. For the 10 months after, home costs grew an average of 9.6 percent — not exactly a bust.

In 2015, Denver and San Francisco had the top markets, with an average home price increase of 10.2 percent in both regions. The next year, Denver dipped ever so slightly to 9.3 percent, and San Francisco only slowed to 7.1 percent.

Dallas has also been among the leaders for the last couple of years, and its price growth has only dropped by two percentage points during that span.

There are early signs of the same pattern playing out in Seattle. The region peaked with a home price increase of 13.5 percent earlier this fall, and price growth has dropped slightly for each of the last three months.

Even if that pace of decline continues, Seattle would continue to see double-digit price increases for at least the first half of 2018.

https://www.seattletimes.com/business/real-estate/seattle-extends-its-run-as-the-nations-hottest-housing-market/

We are saddened by the passing of Dick Enberg, but enjoying the many stories about the long-time La Jollan:

In the 1970 opening conference game in Pauley Pavilion, Oregon went into a stall against the UCLA Bruins. Enberg had run out of statistics and began to fill his radio broadcast with small talk. The movie Butch Cassidy and the Sundance Kid had just been released, and Enberg was humming the tune to “Raindrops Keep Fallin’ on My Head”, but did not know the words.

Two nights later, in a home game against Oregon State, many UCLA students brought the lyrics to the song. Enberg promised that he would sing the song if UCLA won the conference championship. He sang the song following the final game of the season!

The event was recorded in the Los Angeles Times and was later recounted in the book Pauley Pavilion: College Basketball’s Showplaceby David Smale. During the 2006 NCAA Men’s Basketball Championship broadcast, there was a short feature on the event.

You’d think I’d get tired on my predictions being wrong because they were just a little bit early.