As long as the House and Senate can agree, it appears that the tax reform bill will include the existing tax incentives for home buyers (M.I.D. and property-tax deduction up to $10,000). The N.A.R. and C.A.R. aren’t happy though, and are still fighting the fight.

Today, the C.A.R. issued this explanation:

We must reverse the decline in California’s homeownership rate. For over 100 years Congress has incentivized homeownership with the tax code; currently through the mortgage interest deduction. Any effort at reforming the tax code should maintain and prioritize this incentive. The current proposal only pays lip service to incentivizing homeownership. The proposed changes will result in only top earners itemizing their deductions. Therefore, the vast majority of people will no longer receive any tax incentive to purchase a home. So, while the proposal keeps the mortgage interest deduction, the incentive effect of the deduction for Americans to become homeowners disappears.

If you don’t earn enough money to itemize your deductions, you’re probably not buying a house around the coast. It would be nice if they included their math so we could see who they claim as the ‘vast majority’ of buyers.

The M.I.D. and the property-tax deduction are the two primary incentives for home buyers – and they should make it into the final version of the bill.

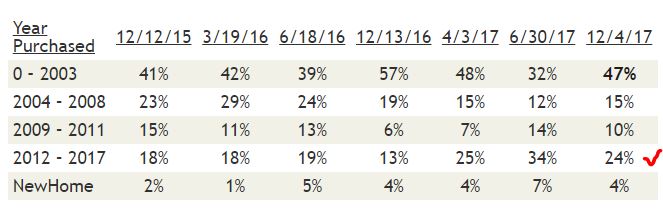

What about the five-out-of-eight years rule? It is a concern for recent purchasers only. The long-timers who make up about half of our sales already qualify for the new rule too.

As you can see in the chart above, on average about 22% of our sellers are recent purchasers. But the actual number of potential delayers is lower.

Today’s stats are from the 116 NSDCC sales we’ve had since November 15th. The 24% equals 28 sales, but five of those were flips, and five others had bought in 2012, and happened to sell right after their fifth anniversary. There were also a couple who sold in less than two years, so they paid the capital-gains tax anyway.

In summary, there were 16 sellers who sold between their two-year and five-year anniversary, or 14% of the total.

It suggests that roughly 14% of the potential sellers over the next 2-3 years might delay their plans to sell, in order to qualify for the tax-free profits. Great, even less inventory – hopefully the estate sales will increase!

The year-over-year sales were already lower in October by 5%, and November isn’t looking any better – and the tax reform hasn’t happened yet. I think we can expect 5% to 10% fewer sales in 2018!

This change to a five-out-of-eight benefit doesn’t really affect today’s buyers – most are planning to stay long-term. The average length of homeownership is already eleven years, and likely to go longer.

The homeowners who will suffer are those who have several houses and planned to move into each for two years to qualify – like Rob Dawg. But if it means you only get to take advantage of the rule once or twice instead of three or four times, at least some benefit came your way – sorry they changed the rules on you. Maybe you can run for president, and fix it? Lower the capital-gains tax while you’re at it!

The math is pretty simple…with the std deduction for married couples at $24K, Californians who own homes w/ mortgages ~$500k OR LESS won’t really be able to itemize (due to the loss of the state income tax deduction. It’s kind of ingenious by the GOP) as the interest and property taxes alone won’t exceed the std deduction. They can claim they didn’t touch the home incentives but they’ve indirectly taken away the incentive altogether.

The math is kinda obvious as we know the std deduction for couples is getting upped to $24K. Most people’s interest and prop taxes won’t be over that amount without the state income tax deduction.

Come on, C.A.R.!

Stop trying to kill the bill and kill the bill!!!!!!!