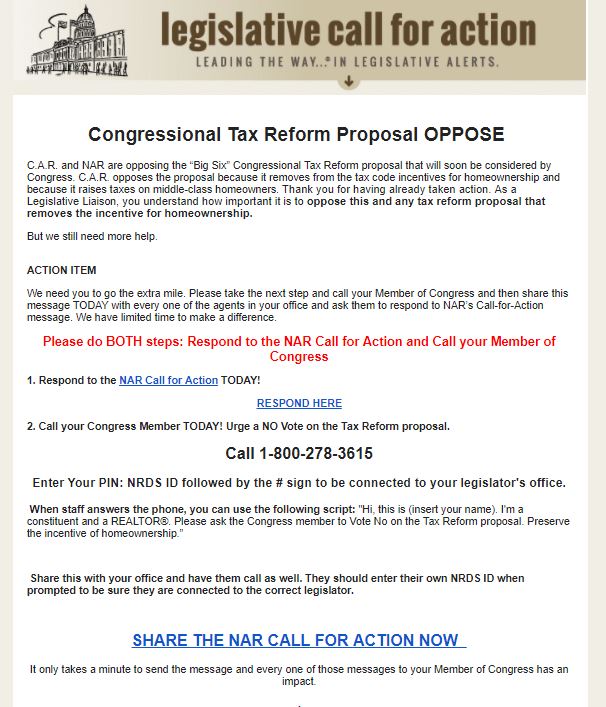

The California Association of Realtors is pushing realtors to object to the Big Six tax reform. Here are the reasons why:

C.A.R. OPPOSES the Tax Reform Proposal Because:

We must reverse the decline in California’s homeownership rate. For over 100 years Congress has incentivized homeownership with the tax code; currently through the mortgage interest deduction. Any effort at reforming the tax code should maintain and prioritize this incentive. The current proposal only pays lip service to incentivizing homeownership. The proposed changes will result in only five-percent of taxpayers itemizing their deductions. Therefore, the vast majority of people will no longer receive any tax incentive to purchase a home. So, while the proposal keeps the mortgage interest deduction, the incentive effect of the deduction for Americans to become homeowners disappears.

This is a tax increase on California homebuyers and homeowners. Congress needs to protect taxpayers from double-taxation and maintain the deduction for state and local taxes, including property taxes. Not allowing the average homeowner in California to deduct their property, state and local taxes would effectively raise their taxes $3,000 a year! The Federal government would tax families on money paid to the state and to local governments they never used.

That’s all you got?

Tax reforms will come and go. Buy a house to lock down your living expenses, and provide housing stability for generations to come.

If and I mean IF, tax reform is created this year, look for the deduction for property taxs to remain as a deduction, but payment of state taxs to be eliminated. which makes home ownership really the only way OUT of any kind of tax liability. Given the hostile nature of the current administration, I believe everybody on the fence on solar..needs to get on board, there will probably not be a 30% tax credit after 2018…and that tax credit is GOLD looking at the way things could turn out. As well, as import tax on panels increasing the cost of materials.

In some ways, the only way out here is a mortgage payment..I know there is a limit of 1mil…and any changes to the deduction amount in my opinion, would be grandfathered in, meaning that your mortgage today would remain 100% deductible.