Did you file an extension for your 2016 tax returns, and are trying to buy a house? Have you released your financing contingency yet?

Here’s what you have to do to qualify for a mortgage:

Yes, “Tax Day” has passed, and lenders and investors must consider filed taxes in their underwriting decision. For example, LHFS issued a reminder regarding 4506 transcripts. Loans dispersed on or after April 18th will require the 2015 and 2016 returns or all the following:

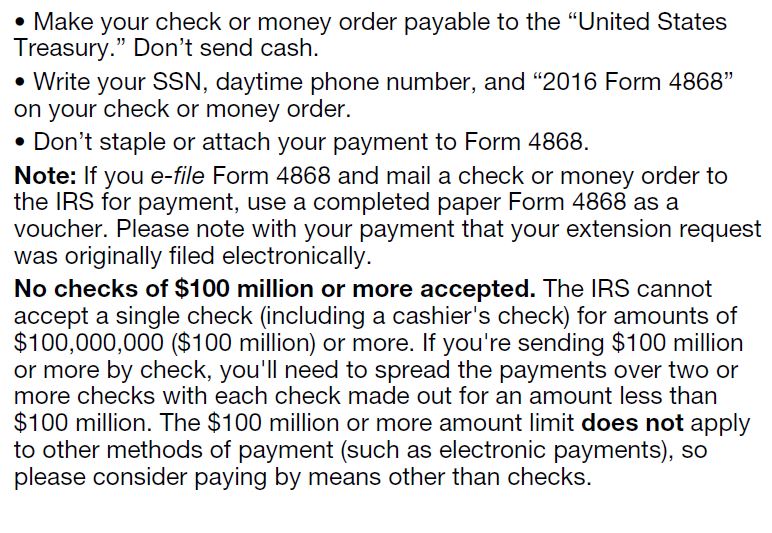

Evidence of filing a Tax Extension (IRS Form 4868-Application for Automatic Extension of Time to File U.S. Individual Income Tax Return) filed with the IRS; Tax liability reported must be compared to the borrower’s tax liability for the previous 2 years as a measure of income source stability & continuance. An estimated tax liability that is inconsistent with previous years may make it necessary to require the current years return to proceed. IRS Form 4506-T Transcripts confirming “No transcript available” for the applicable tax year; and Returns for the prior two years.

If you owe additional taxes and sent in an amount with your extension, don’t be surprised if your lender will want to see evidence of that too. Also note:

If you are sending in $100 million or more in taxes, I’ll be happy to drive your money to the post office!