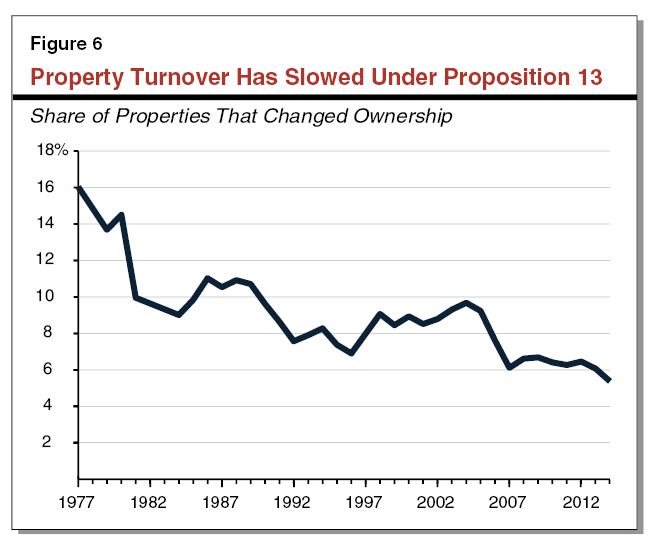

The low-inventory conditions have several contributing factors, one of which is the Prop 13 cap on property taxes. The long-time owners sure don’t want to pay what would be much-higher taxes if they move up, thus the turnover has slowed considerably:

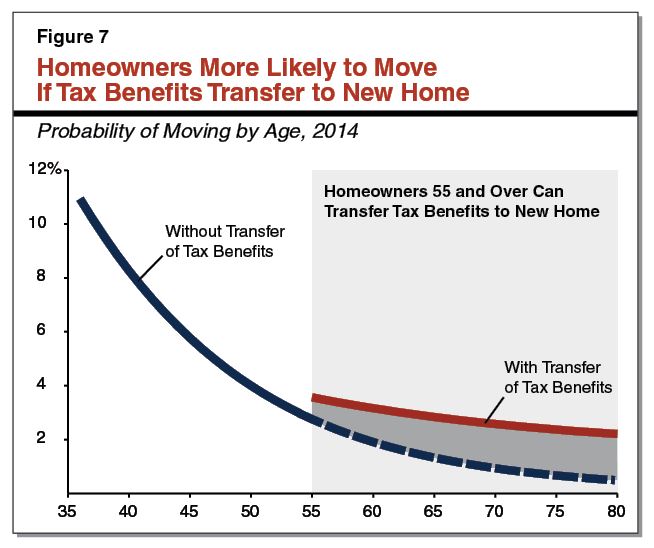

Moving down, price-wise, to keep your old tax basis isn’t easy either. Though this graph shows that twice as many people would move if they could take their tax benefits with them, it’s not enough to get older people to sell. By the time you are 65, the chance of you selling is less than 4%, and that’s with the tax benefits transferring:

Move before you get old!

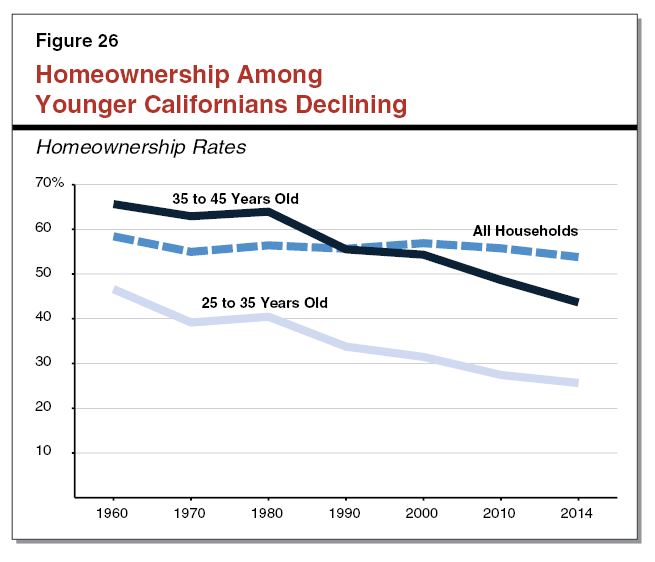

Here is the big concern – how many younger folks are coming up that are ready, willing, and able to buy your house for what you think it is worth today?

Your house comes with a stifling property-tax bill, and fewer are going for it:

The residual effects of prop 13, combined with the high federal and state income taxes paid on the profit above $500,000 will cause fewer and fewer long-timers to want to sell. Eventually, it means the inventory will be stocked with estate sales and sellers who NEED to sell.

The full report on Prop 13 is here:

http://lao.ca.gov/Publications/Report/3497

ah yes….the laws of unintended consequences are clearly on display here.

Howard Jarvis has been dead for 30 years. Maybe it is time to re-visit?

Though I’m not sure you could find a solution that would get a 2/3 vote, until enough old people died.

Jarvis was a Republican primary candidate for the U.S. Senate in California in 1962, but the nomination and the election went to the moderate Republican Thomas Kuchel. Subsequently, he ran several times for Mayor of Los Angeles on an anti-tax platform and gained a reputation as a harsh critic of government. An Orange County businessman, he went on to lead the Howard Jarvis Taxpayers Association and spearheaded Proposition 13,[4] the California property tax-cutting initiative passed in 1978 which slashed property taxes by 57%.

I have two neighbors with similar homes:

One long time owner pays $1600 a year taxes , the new neighbor next door pays $16500 a year.

Hmmmmm.

Also nice that one paid $30k for their home in 1968 and the other paid 1.6 Mill recently.

talking about the odds stacked against you…..

Another example!

My parents had my childhood home (3,533 sq. feet) built in 1953.The present owners bought it in 1995 for $625K. Property taxes: $10,764.

A neighbor’s home (3,377 sq. feet)-still has the original owners who are now both in their 90’s–property taxes: $3,184. I bet it was built for $25-30K in the early 1950’s.

Zestimate for both homes is about $2.2 million.

Prop 13 is working just fine. Keeps original homeowner’s from being hosed out of their home via wild property tax increases fomented and enabled by sociopathic Jesuit maniacs who can rationalize anything.

And remember, when you buy a house, you’re a beneficiary of Prop 13 too, so YOU don’t get booted out of YOUR house when you’re older, retired, and intending to enjoy what you worked for. It encourages homeownership, and community, instead of unleashed opportunistic scabbery by wretched, faceless corporate cretins who think your life is their game.

I agree it will take the older people dying off to pull down Prop 13, because I’ve noticed young people are generally the only group of americans stupid enough to actually vote themselves a tax increase. Not all young folks are dumb, but enough are to make life ridiculous.

Let’s just take a couple of bites out of it first.

People who inherit a house don’t need to pay the same lower tax rate. Call it the ‘deadbeat checker’. If you inherit a house, then you have the benefit of refinancing tax-free and pulling out hundreds of thousands of dollars tax free. The least you could do is pay a higher property tax.

I agree the better solution is that the tax freeze should expire in most cases with the death of the final original owner. Or perhaps as in Tx a freeze when the first owner reaches 65. When I inherited my house in Tx the tax bill went up more that 2 times (at that time the freeze was just for school taxes, now it is school and county taxes). Note that national figures suggest that such a freeze would last somewhat more than 20 years. (Life expectancy at 65 is 19.3 years)

What about Props 60/90/110? Are they not available in San Diego county?

From what I’ve read, another negative due to Prop 13 was less money going to public schools and infrastructure. Since moving to San Diego from Phoenix, AZ 3 years ago, I was shocked at the poor quality of San Diego’s streets and the dilapidated conditions of most of its public schools. Now I see why.

Since historical homeowners pay less and new home buyers pay so much more, shouldn’t the new home buyers get more for their money?

But, under Prop 13, both get the same city services and the same access to local schools.

Tossing old folks out into the streets because they can’t afford to pay their property taxes isn’t right.

But, neither is gouging new homeowners for the same level of service as their long term neighbors.

There has to be a better, more equitable way.

Maybe adjust Prop 13 so that the sellers can transfer their original tax base to the buyers, for some sort of one time transfer fee that goes to the city/county. This would make it a one time fee (at purchase) instead of paying exorbitant property taxes forever.

What about Props 60/90/110? Are they not available in San Diego county?

Yes, San Diego County is one of the counties that allow taxpayers to take their old tax basis with them if they move down, price-wise. It is another aspect that should be in the cross-hairs of any tax revolution, because if you can afford a house these days, you should pay the same tax as everyone else.

But I’m not sure how many people take advantage of it because it is difficult to pull off.

It was a pretty simple checklist form.

As I remember you have a two year window. The new home price must be equal or less than the one you sold with that amount increased by 5% each year for the next two years

Yes, that is the formula and the checklist is easy.

It is finding a suitable home for less that is the tough part. For those who want to stay in the same neighborhood, you have to purchase an inferior home to the one you are selling, and older folks don’t like the idea of a fixer or dump.

It works great if you leave RSF and move to Carlsbad, or leave Carlsbad and move to Ramona, or leave SD County and move to Fresno. You get a terrific home and bank the rest (after taxes).

I am over 65. What if I purchase a home of greater value, can I apply the lower tax rate to a portion of the second home and pay full tax rate on the remaining?

I’m going to leave that one up to your tax accountant Roger!