Want to guess when the best time will be to sell your house in 2016?

Let’s reflect on recent history.

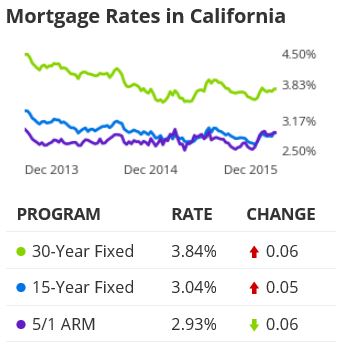

The Big Frenzy of 2013 was super-charged by mortgage rates dropping into the low-3s during 4Q12. The low point for the 30Y conforming rate was 3.31% during the week of Thanksgiving.

It skewed the sales history of early 2013 higher, but then rates started rising which tempered the market. By the time we got into 2014, rates had to decline most of the year just to keep the market afloat. Those two histories are unlikely to be duplicated in 2016.

Rates were back into the 3s by the end of 2014, which helped 2015 get off to a good start – and now rates have muddled through the rest of this year.

Because of the highly-publicized Fed hike this month, home buyers have to be thinking that it’s time to buy – before rates go higher. The Fed has threatened to raise rates throughout 2016, which should cause buyers to be very active early on.

As a result, let’s compare our 2016 market expectations to 2015 – the recent sales history that will be most-likely to repeat.

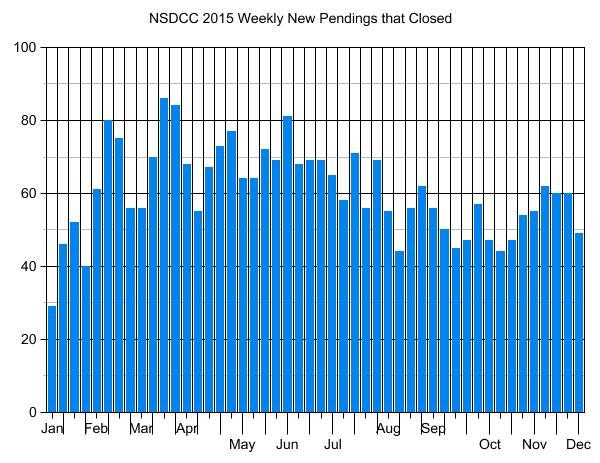

These are the weekly counts of NSDCC detached-homes that have closed escrow, based on when they were marked pending. Starting in mid-October, I included the listings that are currently marked pending too, figuring that they have released their contingencies and should be closing soon.

Once the Super Bowl is over, the motivated buyers really get busy. You can see that February, 2015 was one of the best months of the year to find a buyer.

This year is wrapping up nicely, with the 4Q15 action being better than 3Q15. It should provide a solid foundation for early 2016.

Let’s consider the difference between wanting to sell, and having to sell.

If you really needed to sell, you probably got it done in 2014 or 2015. Prices were hitting all-time highs, and the motivated sellers weren’t going to wait around any longer.

The 2016 sellers are more likely to be the lesser-motivated, “if-I-get-my-price” sellers. It will be irresistible for them to tack on that extra 5% to 10%, just in case, and by the end of spring we could see the OPTs stacking up. I thought it might happen like that in 2015, but it didn’t so who knows. But one of these years the buyers will have had enough.

Sell before that happens!